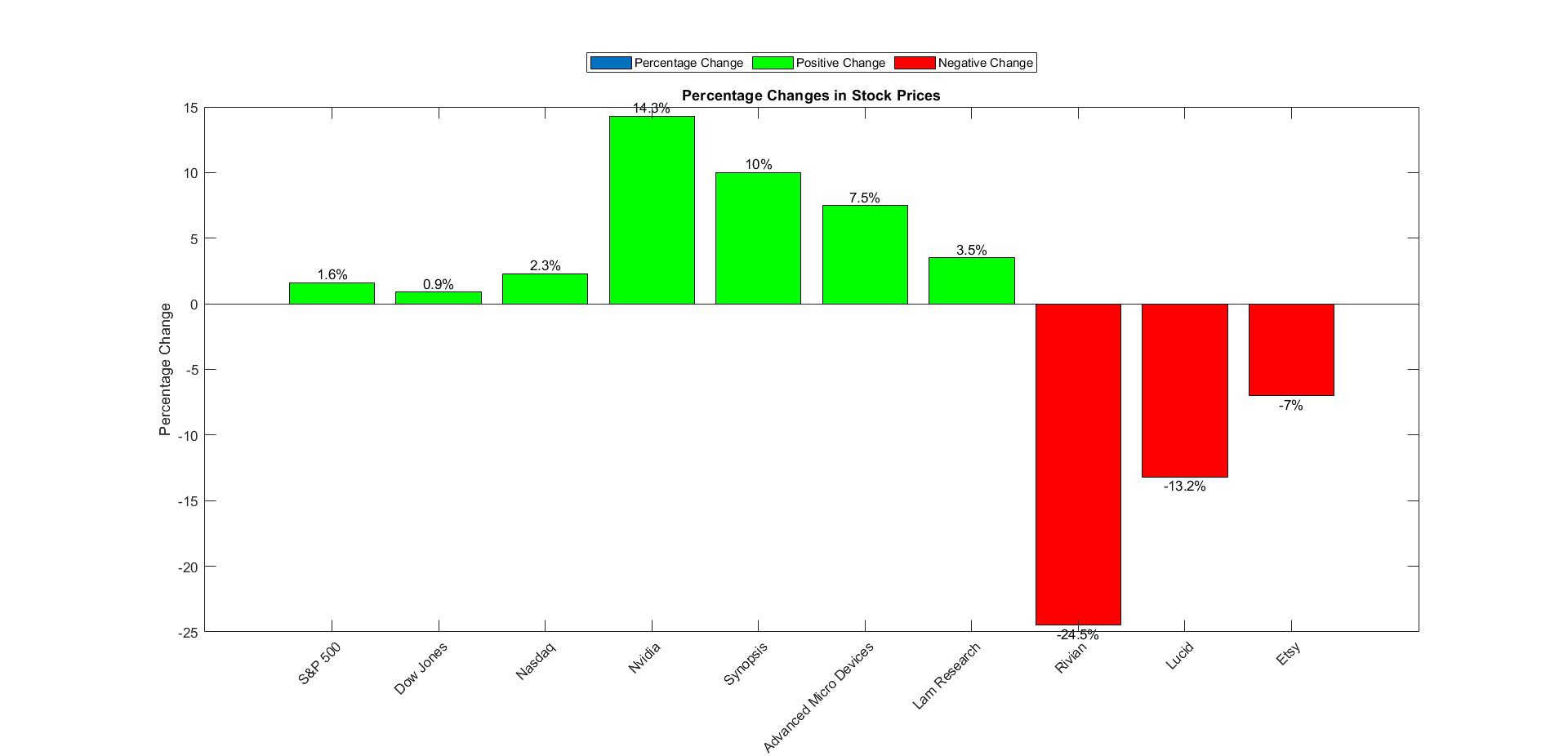

In a dramatic turn of events, Wall Street experienced a significant surge today, largely propelled by the remarkable performance of Nvidia, the AI chipmaking giant. Following Nvidia’s announcement of yet another exceptional quarter, the S&P 500 soared by 1.6% during morning trading, rejuvenating investor sentiment after two relatively subdued days.

The Dow Jones Industrial Average also witnessed a notable uptick, rising by 358 points, or 0.9%, reaching 38,970 as of 9:59 a.m. Eastern Time. Simultaneously, the tech-heavy Nasdaq index surged by an impressive 2.3%.

Nvidia, in particular, stole the spotlight with a remarkable 14.3% surge in its stock value. The company’s stellar performance was attributed to its exponential revenue and profit growth in the latest quarter, driven by soaring demand for its AI chips. Over the past year, Nvidia’s stock has witnessed an astonishing threefold increase, fueled by fervent investor optimism surrounding the potential of artificial intelligence.

Furthermore, Synopsis, a software company specializing in chip testing and development, experienced a notable upswing of 10% after revising its profit forecast upwards.

The ripple effect of Nvidia’s success reverberated throughout the chipmaking industry, with other key players enjoying substantial gains. Advanced Micro Devices (AMD) saw its stock rise by 7.5%, while Lam Research recorded a 3.5% increase.

Internationally, Japan’s Nikkei 225 index reached an unprecedented all-time high overnight. The surge was fueled by record corporate earnings and the depreciation of the Japanese yen against the U.S. dollar, further enhancing the attractiveness of Japanese company shares.

This positive momentum extended across Asian and European markets, contributing to a global uptick in investor confidence.

Despite the overall bullish trend, some companies faced significant setbacks. Rivian, the electric truck and SUV manufacturer, witnessed a sharp decline of 24.5% following disappointing financial results and subdued production guidance. Similarly, Lucid, another electric vehicle manufacturer, experienced a 13.2% decline after falling short of Wall Street’s sales expectations and providing a cautious production forecast.

In the tech sector, online craft marketplace Etsy saw its stock dip by 7% after failing to meet Wall Street’s profit projections by a wide margin.

As Wall Street continues to navigate through volatile market conditions, Nvidia’s exceptional performance serves as a beacon of hope, revitalizing investor optimism and driving the broader market to new heights.

Also read: