Important Questions Next Gen Heirs Need to Address for a Living Trust: For many family businesses, the concept of business succession and passing down trusts can be a competitive and tricky path for finding a middle ground and acknowledging crucial aspects that need to be implemented. Statistics show that 70% of the time, family assets are lost from one generation to the next, and 90% of assets are depleted by the third generation. This can be due to the comprehensive pre-planning and the desire to only focus on the provider of the will or trust rather than looking at the receiver and what they need to be aware of.

Often, receivers end up left out of some components of how to uphold the trusts and assets they are receiving. According to statistics, 30% of family business transitions succeed, which means 70% of those businesses—and the accompanying wealth transfers—fail. However, with the help of estate planning and connecting with professionals, youth and next-generation heirs can become more aware of how to navigate their assets and ensure a successful transition, especially if the trust is handed down from a past family business.

The Importance of an Estate Plan: Wills versus Trusts

Creating an estate plan is gaining popularity across all age groups as many have seen the importance of protecting one’s assets during the COVID-19 pandemic. When many first hear the word “estate,” you may think of an actual estate such as a property or mansion; however, the term references the overall collection of assets over the years.

Estate plans often consist of six crucial components: Will/trust, Durable power of attorney, Beneficiary designations, Letter of intent, Healthcare power of attorney, and Guardianship designations. Of the six components, the most important is a will or trust. Everyone should have one prepared even if the person may not have an excessive amount of assets. However, when deciding upon a will or trust, it’s important to note the difference between the two. A will is defined by Merriam’s Dictionary as a legal document of a person’s wishes regarding the disposal of their property or estate after death. A living trust is a legal arrangement established by an individual (the grantor) during their lifetime to protect their assets and direct their distribution after the grantor’s death. Learning the importance of the two is critical for not only the person making the plan but also the person who will be in charge of receiving the overall property or asset being handed down.

How a Trust Works

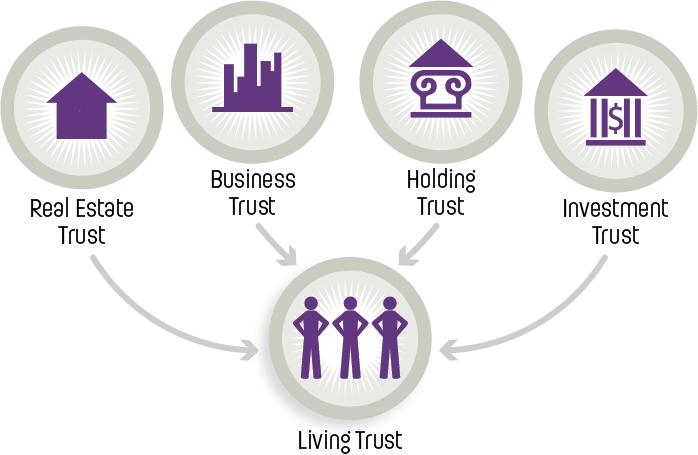

There are many different ways to proceed with trusts regarding how assets are arranged. A living trust is beneficial because it helps family members and those associated with avoiding the possibility of a probate process. The assets in a trust are transferred over to beneficiaries or heirs after the death.

The process begins with a person considering the trust’s grantor and meeting with a professional in the estate planning space to create a plan and determine what assets need to go into the trust. Assets can consist of the following:

- Stock and bond certificates and safe deposit boxes

- Mutual fund accounts, brokerage accounts

- Money market accounts, certificates of deposit

- Checking and saving accounts and cash

- Money owed to you

- Life insurance policies

- Non-qualified annuities

After the assets are taken care of, the grantor appoints a beneficiary or heir to the trust. Once the grantor passes, the assets granted are then automatically transferred to the beneficiary according to the creator’s wish, according to legal documents.

Next Steps and What Next Gen Heirs Need to Ask

The role of an estate planning attorney is to help access a grantor’s assets and how to best create a successful plan for the person receiving the assets. Law firms such as Estate Law Center offer online assistance and even workshops that educate the general public on all the steps for estate planning, specifically wills and trusts.

For next-generation heirs, receiving assets depending on what they are can be a learning curve and can leave some unsure of how to maneuver their way through any questions they may have. This is where the help of estate planning professionals comes in by helping to educate the beneficiary on their new responsibilities as specified in the trust.

When agreeing to a will, there are some critical questions to ask as being titled the beneficiary is an honor but great responsibility. Some questions to ask are:

- What is the overall goal of the trust?

- How much will the beneficiary be receiving on their end?

- To request to read the trust.

Some questions for the beneficiary or heir to ask afterward once the trust sets into place and assets are transferred are:

- How long will the responsibilities listed in the trust last?

- Will the beneficiary be held liable?

- What are the options if the duties become too much?

Moving Forward

For those on the receiving end of a trust, it’s best to be prepared and informed on the overall process of creating a trust to continue one’s legacy and successfully manage assets. With the right team, estate plan, and knowledgeable understanding of wills and trusts one can accurately access and maintain assets that have been passed down.

About Holly Geerdes:

Holly Geerdes possesses over 22 years of experience in the legal field and is considered one of the premier trial and asset protection attorneys in the United States. She has been named in the “Top 100 ” litigators by the National Trial Lawyers and is currently serving as Estate Law Center’s founding attorney.