MAXIMIZE YOUR SOCIAL IMPACT: Those of us that pay personal and/or business tax in the United States know how far-reaching Uncle Sam can be. As a result, I have always been interested in different sections of the tax code that may offer some potential relief. Understanding the sections that allow for tax breaks for doing good in the world is especially intriguing to us as it is aligned with our core philosophy of Doing Well by Doing Good.

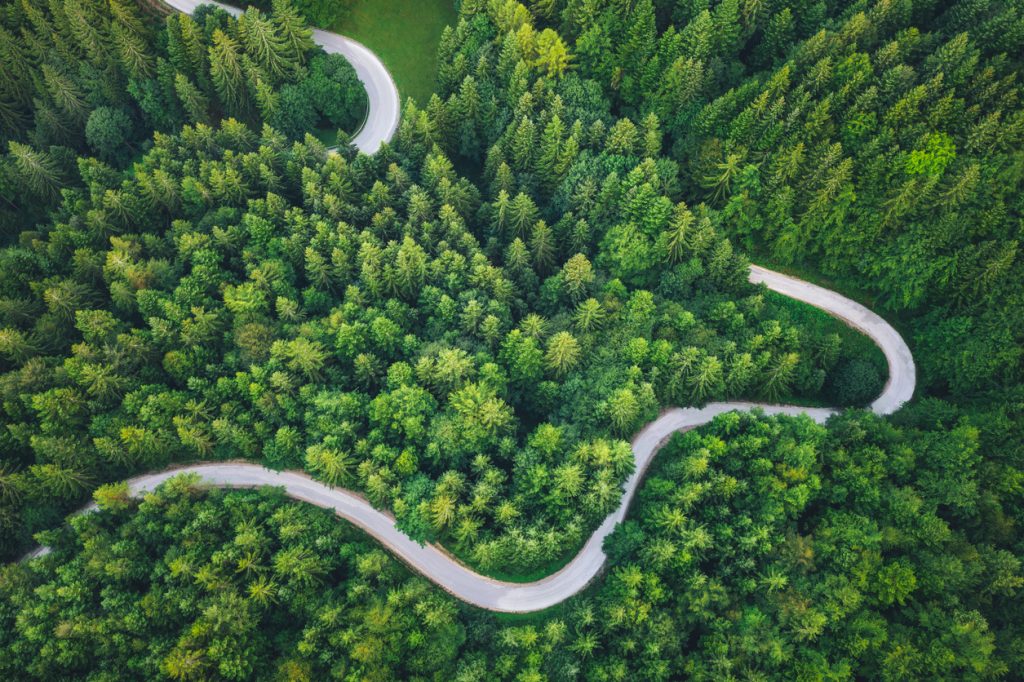

Land conservation

There are multiple ways to donate land and receive tax benefits. One way is when a landowner makes a complete donation of land to a qualified organization. That donation may be claimed as a charitable income tax deduction based on the property’s fair market value for up to 30% of the taxpayer’s adjusted gross income (AGI). AGI includes all types of income, from earned to passive to capital gains. Another program that also helps the environment, is a lesser-known strategy for creating conservation easements. A conservation easement is a voluntary, legal agreement that permanently limits uses of land to safeguard its conservation values and protect the land for future generations. All conservation easements must provide public benefits, such as water quality, farm and ranch land preservation, scenic views, wildlife habitat, outdoor recreation, education, and/or historic preservation. A conservation easement donation can result in significant tax benefits if it meets the requirements of federal law. There are three main advantages of conservation easements.

An investor:

1. May qualify to deduct up to 50% of your adjusted gross income.

2. Can carry it forward for up to 15 years, as opposed to 5 years with a simple land donation; and

3. Still owns the land and can enjoy it in its natural state for as long as they own it.

This can be especially beneficial if you own a home on a large parcel of land. You can retain your normal rights on the portion of land that your house sits on, while donating the easement on the adjoining parcel. This would allow for you and your family to enjoy certain activities such as hiking, riding horses and enjoying the natural beauty of the land, while potentially making significant tax savings. This is often beneficial in estate planning, as it may help you pass on your land to the next generation at a substantially reduced valuation. (IRS Section 170H)

Tax-advantaged real estate investments

The IRS offers deferral of capital gains taxes when the proceeds from the sale of an investment property is “exchanged” for a like kind property of equal or lesser value within specific time limits. Commonly referred to as a 1031 exchange, this strategy can be used to defer capital gains tax until a later date in the future, and there is no limit to the number of exchanges an individual can complete. (IRS Section 1031)

Another investment strategy to consider when seeking to offset capital gains taxes are Opportunity Zones. When the U.S. Congress passed the Tax Cuts and Jobs Act in December of 2017, a new section of the Tax Code was created which resulted in the creation of Opportunity Zones across the United States.

An Opportunity Zone is a community that has been designated by the state and certified by the IRS to stimulate economic activity in certain selected areas across the country. Roughly 8,700 areas in all 50 states have been designated. Opportunity Zone investments allow investors to defer capital gains taxes until 2026. After that date, their tax liability on the original capital gains event will be due, however, if the investment in the fund was made prior to December 31, 2021, the amount is reduced by 10 percent. The biggest advantage is that if the investment is held in an Opportunity Zone Fund for 10 years or more, there is the potential to not owe federal taxes on profits earned in the Fund.

In summary, if you dig deep enough, the U.S. tax code does offer opportunities to reduce both income and capital gains taxes. It is important to consult your accountant and other advisors to fully understand the impact to your unique situation and determine if any of these sections of the tax code may be beneficial to you. Understanding how to offset some of your tax liability can potentially provide you with additional funds to deploy to further your business and philanthropic goals – a winning combination.

Keystone National Properties is a real estate and private equity firm specializing in the sponsorship of tax-advantaged and impact investment opportunities for accredited investors and Family Offices.

Keystone National Properties (including its subsidiaries and affiliates) does not provide tax, legal, or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal, or accounting advice. You should consult your own tax, legal, and accounting advisors before engaging in any transaction.

MIKE PACKMAN | FOUNDER & CEO

KEYSTONE NATIONAL PROPERTIES | KNPRE.COM