When you own a luxury estate, you can be sure it’s not just about prestige and comfort; it’s also about managing, if not avoiding, potential risks that come with the grandeur of your property. Accidents can still happen even in the most immaculate spaces, no matter the cost of your upkeep.

When mishaps occur, they can result in costly lawsuits, loss of reputation, financial setbacks, and stress from all the fuss.

That’s why, If you’re a luxury property owner, here’s what you need to know to shield and clear your estate from liability.

Understanding the Risks: More than Just Slip and Falls

Luxury estates often come with expansive landscapes, pools, private gyms, and intricate architectural details or sculptural installations that, while beautiful, can also be hazardous.

Many elements can lead to accidents, from a guest slipping by the pool to structural hazards in your custom designs. Knowing what to look for can help you mitigate risks before they become costly incidents.

Key Liability Risks in High-End Estates

● Pools and Water Features

Unfenced pools or slippery areas are common causes of injuries.

● Unusual Structures

Custom staircases, mezzanines, and balconies add charm but can also present fall risks if improperly maintained.

● Private Gyms and Fitness Areas

Poorly installed or aged gym equipment and accessories can lead to or cause mishaps, if not big-deal accidents.

● Landscaping Hazards

Uneven walkways, decorative rock paths, and loose stones are potential tripping or falling hazards.

Identifying these risks is only the first step. By adopting a more proactive property management trait coupled with focused legal measures, you can competently protect your luxury estate from potential liabilities, giving you peace of mind instead.

Essential Property Upkeep: Prevention Is Better than Cure

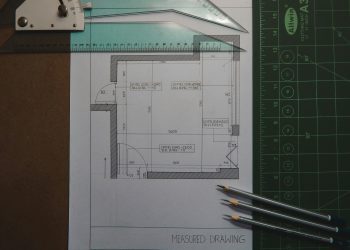

Preventative maintenance is critical for luxury estate owners. Regular inspections, upkeep, and immediate repairs for problem areas can significantly reduce liability risks.

Actionable Upkeep Tips

● Regular Inspections

Schedule quarterly professional inspections to identify and rectify hazards like slippery floors, loose railings, or overgrown pathways.

● Pool Safety Features

Install barriers or alarms for pools to prevent accidental falls, especially if children or elderly guests frequent the property.

● Landscape Management

Keep pathways clear, ensure proper lighting at night, and promptly address uneven ground or broken tiles.

● Equipment Checks

For estates with gym equipment, regular maintenance or servicing is essential to ensure all devices are in superb working order.

As you make these tasks a necessary routine, you not only lower possible liability but also enhance your property’s value by maintaining its aesthetic appeal and functionality overall.

Legal Safeguards: Knowing Your Responsibilities as a Luxury Estate Owner

Beyond your maintenance and insurance reservations, you also need legal safeguards that can be essential to liability-proof your estate, especially when a slip and fall accident occurs. It’s a fact that no matter how you’ve “proved” your property, unavoidable incidents still happen in one way or another.

Luxury estates, in particular, often attract guests, from family and friends to event attendees, which makes liability issues complex and requires a legal guide every step of the way. Working closely with an experienced attorney can ensure your estate complies with all local regulations and is well-protected in the event of an accident.

Legal Steps to Protect Your Estate

● Waivers and Disclaimers

Especially when your luxury property has high-risk areas, consider asking guests to sign waivers or posting disclaimers at the entrance or some conspicuous areas in your estate.

● Legal Review of Amenities

It’s best to make sure that features like pools and private gyms meet local code standards so you can avoid compliance issues.

● Estate-Specific Liability Consultation

You may also create an estate-specific liability plan with a legal professional. This can effectively address unique elements not covered in your insurance policies.

The Right Insurance for Full Coverage

Insurance coverage can indeed be a lifesaver, especially in the face of potential lawsuits. However, a standard policy may not provide the coverage you really need for your luxury property. Customized insurance solutions tailored to high-value properties might just be what you need.

Insurance Essentials

● Comprehensive Liability Coverage

You should go beyond basic homeowner’s insurance and opt for comprehensive liability insurance that covers unique property features and all associated risks.

● Umbrella Policy

A personal umbrella policy may be beneficial for extending your coverage limits, providing extra protection if an accident causes significant damages or losses.

● Specialty Riders for High-Risk Amenities

If your property has amenities and exciting features like pools, guest houses, or gyms, you may need specialty riders to cover these areas. This ensures comprehensive coverage for all aspects of luxury ownership.

Endnotes: Making Your Estate Liability-Proof

While going out of your way, like focusing more on specialized or targeted maintenance, taking comprehensive insurance, and thoroughly defining the legal scope, you can significantly reduce, if not wholly avoid, the liability risks associated with your luxury estate.

Your proactive planning and steps will not only protect your investment but also ensure a safe and enjoyable experience for you and everyone who visits your property.