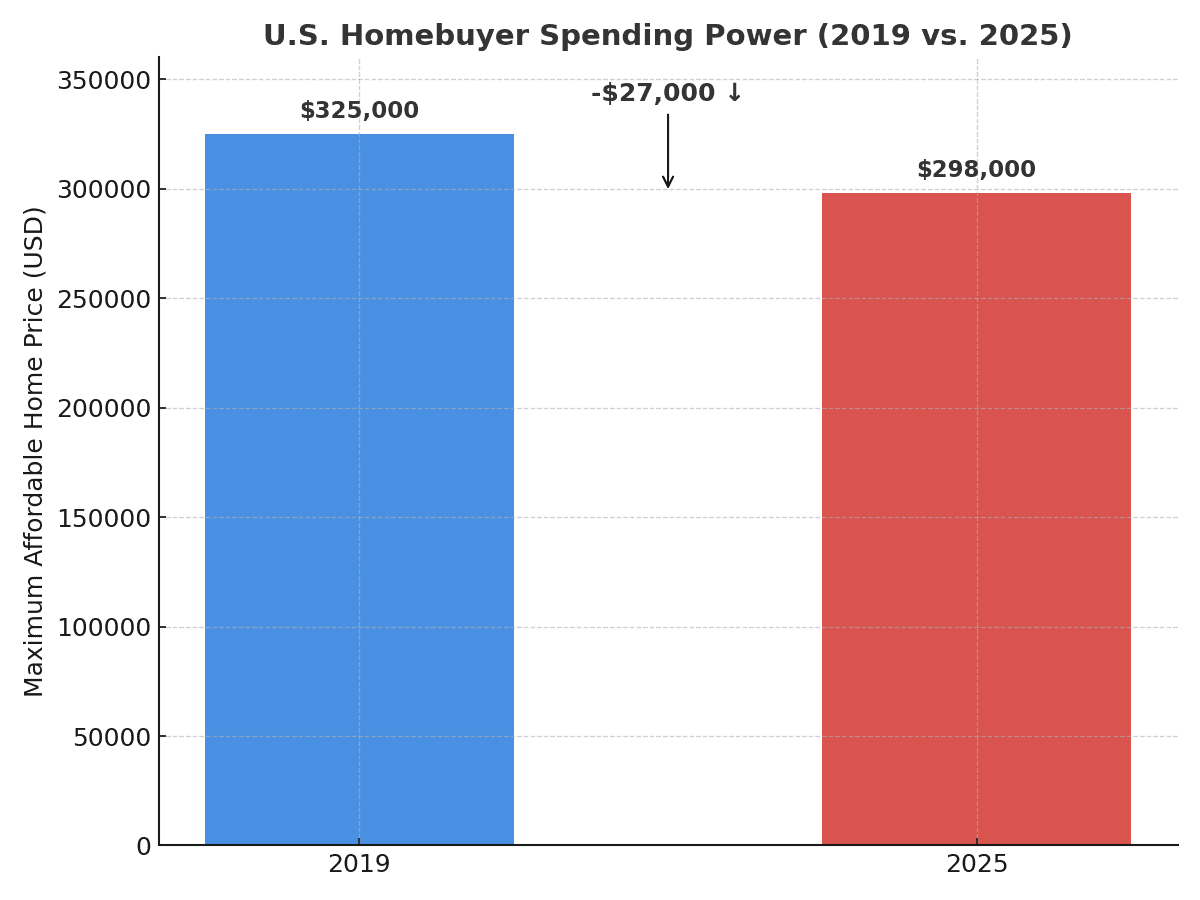

The American dream of homeownership has become increasingly elusive. According to a new Realtor.com report, a typical U.S. homebuyer’s spending power has dropped by nearly $27,000 since 2019—despite wage growth. Rising mortgage rates and surging property prices have squeezed affordability, pushing more aspiring buyers to the sidelines.

The Numbers Behind the Decline

For households earning the national median income, the maximum affordable home price has dropped from $325,000 in 2019 to just $298,000 in 2025.

This drop comes even though wages have grown 16% over the same period, underscoring how rising costs have outpaced income growth. Meanwhile, the median U.S. home price has surged to $439,450 in 2025.

Key Affordability Metrics

| Year | National Median Income Growth | Maximum Affordable Price | Median U.S. Home Price | Mortgage Rate | % of Listings Affordable |

|---|---|---|---|---|---|

| 2019 | Baseline | $325,000 | $299,000 | 4.0% | 55.7% |

| 2025 | +16% | $298,000 | $439,450 | 6.74% | 28.0% |

National buying power has dropped 8.3% since 2019, according to the study.

Also read: Home Prices to Dip in 2024, But Remain Unattainable for Many Buyers

Why Homebuyers Are Losing Ground

The analysis—based on U.S. Census data and Claritas 2025 estimates—assumes:

-

A 20% down payment

-

A 4% mortgage rate in 2019 vs. 6.74% in 2025

-

The 30% affordability rule, meaning households should spend no more than 30% of gross income on housing

This affordability crunch is widening the gap between renters and owners. In fact, homeowners now hold 43 times the wealth of renters, up from 39 times in 2022.

Metros Hit Hardest by Affordability Loss

Not all cities have felt the affordability crunch equally. Some metros are significantly worse off.

Steepest Declines in Buying Power (2019–2025)

| Metro Area | % Change | Buying Power Decline |

|---|---|---|

| Milwaukee | -10.5% | -$33,000 |

| Houston | -9.4% | -$31,000 |

| Baltimore | -9.3% | -$37,000 |

| New York City | -9.3% | -$37,000 |

| Kansas City, Missouri | -9.3% | -$31,000 |

These cities highlight how mortgage costs and price growth have created double pressure on buyers.

Also read: Top 10 U.S. Cities for Affordable First-Time Home Buying Under $250,000

Where Buyers Have Gained Ground

Interestingly, a handful of metros have bucked the national trend. Cleveland saw a 4.4% gain in buying power (about $11,000). Other markets with slight gains show that local dynamics—such as slower price appreciation and stronger wage growth—still matter.

Impact on First-Time Buyers

The decline in affordability has been particularly harsh for first-time homebuyers.

-

The share of affordable listings for median earners dropped from 55.7% in 2019 to just 28% in 2025.

-

Younger Americans are delaying homeownership, while older, wealthier buyers with family assistance dominate the market.

This mirrors broader wealth inequality trends: Federal Reserve data consistently shows homeowners building wealth faster than renters.

Wealth Gap: Renters vs. Owners

| Year | Relative Wealth of Homeowners vs. Renters |

|---|---|

| 2022 | 39x |

| 2025 | 43x |

This growing divide reflects the advantage of holding home equity, especially in a market with persistent price appreciation.

Also: Buy Now, Pay Later? Zero-Down Mortgages Explained for First-Time Homebuyers

What It Means for the Future

The U.S. housing market is increasingly defined by inequality:

-

Existing homeowners are accumulating wealth at record levels.

-

New buyers, especially millennials and Gen Z, face higher barriers to entry.

-

Policy makers may soon face calls for affordability relief, whether through incentives, interest-rate policy, or tax credits for first-time buyers.

Final Takeaway

Homebuyers in 2025 face a market far more expensive, and less forgiving—than just a few years ago. With spending power down by $27,000 and affordability cut in half, the dream of homeownership is slipping further out of reach for millions of Americans.

For those who already own, equity has never been more valuable. For those still trying to buy, patience, creative financing, and exploring alternative markets may be the only way forward.

Also read: $1 Million Starter Homes Become the New Norm: A Deep Dive into the Housing Affordability Crisis