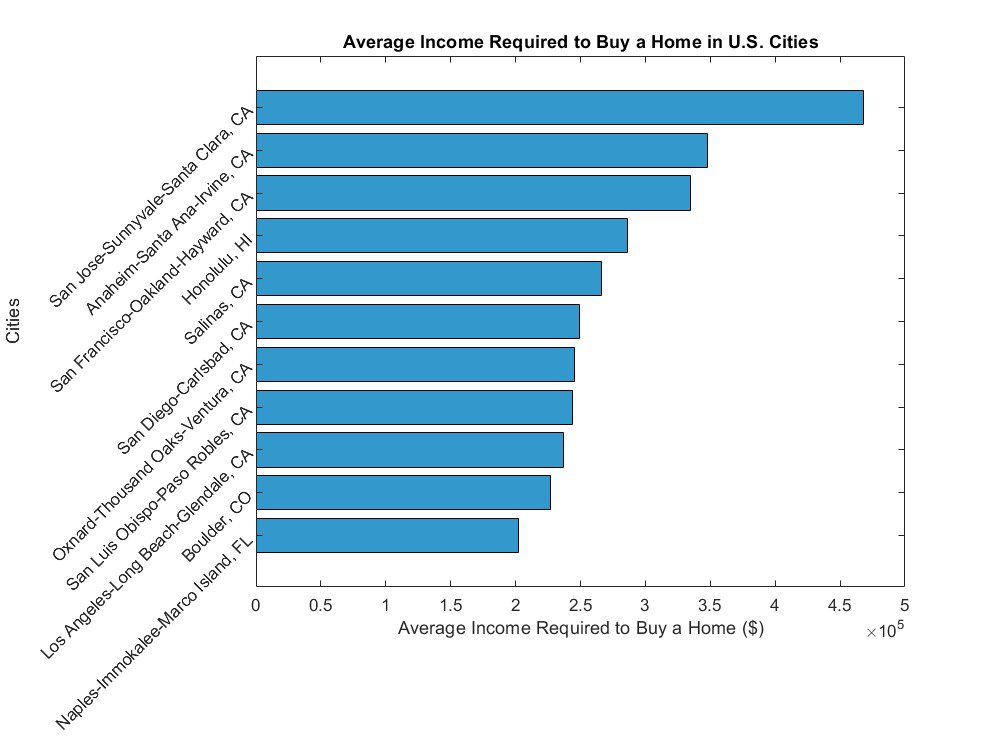

Top 11 U.S. Cities:

In today’s housing market, owning a home is a dream that’s becoming harder to achieve, especially in certain parts of the United States. A recent report from the National Association of Realtors (NAR) highlights the tough reality for potential homebuyers, showing that earning just over six figures may not be enough to buy a typical home, particularly in the West.

According to the NAR report, the Western region stands out as the most expensive area in the country for homeownership. On average, you’d need to earn $161,571 to afford a typical home there. But in some cities, especially in California, the situation is even more daunting, with costs exceeding the $200,000 mark.

For instance, in California’s San Jose-Sunnyvale-Santa Clara area, potential homeowners would need to earn a jaw-dropping $468,252 to afford a house, making it the priciest metro market in the nation. Other California cities like Anaheim-Santa Ana-Irvine and San Francisco-Oakland-Hayward have similarly high income requirements, standing at $347,651 and $334,676, respectively.

But it’s not just California facing this housing affordability crisis. Honolulu, Hawaii, is among the top cities where homeownership remains out of reach for many, with an income requirement of $286,093. And in cities like Salinas, San Diego-Carlsbad, and Los Angeles-Long Beach-Glendale, along with Oxnard-Thousand Oaks-Ventura and San Luis Obispo-Paso Robles, the financial barriers to homeownership are significant.

The soaring housing prices in California can be attributed to high demand and limited supply. Despite efforts to address the housing shortage, the state struggles to keep pace with the growing demand. Home prices in California have surged by 40% in the last four years, driven partly by increased interest in homeownership and historically low interest rates.

While cities like San Jose and San Francisco are home to some of the wealthiest residents in the country, the dream of owning a home remains out of reach for many. Even exclusive areas like Atherton, consistently the most expensive ZIP code in the nation, highlight the widening gap between housing affordability and income levels.

In contrast, the NAR report points to more affordable options in the Midwest and the South, where the income requirements are significantly lower. For example, in the Midwest, the average income needed to buy a home is $74,967, while in the South, it’s $95,511.

NAR’s calculations are based on median sale prices, a 20% down payment, and a 7.37% interest rate, with monthly payments limited to 25% of a household’s income. As the gap between housing costs and income levels widens, addressing housing affordability becomes a pressing issue for policymakers and individuals alike. At ImpactWealth.org, we’re dedicated to providing insights and resources to help navigate the challenges of homeownership and financial well-being in today’s housing market.

Also read this relevant article: Gen Z to Spend $18,000 More on Rent by 30 than Millennials – Study Reveals