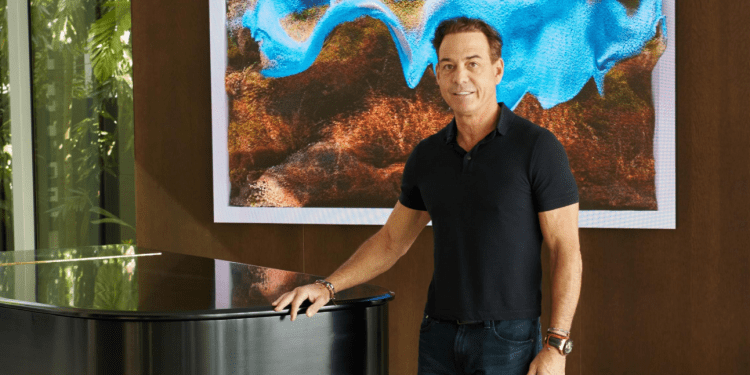

Robert “Bob” Zangrillo, Founder, Chairman and CEO of Dragon Global, a private investment firm focused on venture capital in tech and real estate investments. Zangrillo has managed investments exceeding $1 billion in companies that now have over $500 billion of market value and focuses on “developing Live, Work, Play and Learn communities focused on innovation, art, technology, experience, health and wellness and sustainability.” One of his missions is to evolve humanity and the world by leveraging artificial intelligence and he also looks at companies that specialize in clean technology, cybersecurity, data, ecommerce, the metaverse, mobility, and social networking sectors, amongst others. He has been an early investor in over fifteen high profile companies including DiDi, Digital Turbine, Twitter, Uber Technologies, Zynga and Facebook/Meta. We had a chance to sit down with the businessman to learn more about his philanthropic endeavors, what he attributes his success to, and his selection process for spotting potential unicorn investment opportunities.

IW: Tell us more about Dragon Global.

RZ: My firm Dragon Global is on a mission to leverage artificial intelligence and the Dragon community to evolve humanity and the world. We leverage artificial intelligence across all our investments. We are a co- GP and direct technology investor in innovative early-stage and late-stage tech funds and companies. Our goal is to identify the next trillion-dollar companies. When we look at early-stage investments, we are typically focused on companies we believe can become $10 billion enterprises. My background has been in the capacity of chairman, Chief Executive Officer, board member or advisor to over 15 Unicorn investments including an early stage investor in companies such as Facebook/Meta, Twitter and other tech companies that have achieved market caps in excess of $40 billion and a trillion dollars. I have been doing this by making targeted investments and co-investing with the best investors in the world by focusing on companies led by super-humans.

IW: What are some of your biggest success stories?

RZ: I would say the biggest success stories are on the technology side. From the mid-90s through 2000, I was founder, chairman and CEO of a company called InterWorld that built a high-end eCommerce application software that we licensed on a global basis to the some of the largest e-commerce players in the world. Our customers were large retailers such as Nike, Warner Co, Guess, Marks and Spencer. We also provided the eCommerce software for FedEx or NTT in Japan to host their own eCommerce solutions for their clients. I founded that company with two other friends and within five years this was a $3 billion publicly traded company that was Web 1.0. The second biggest success story was in 2008 when I invested in Facebook when they only had $180 million of revenue, and I became one of the larger early investors before the late-stage venture guys got involved. This year Facebook’s market cap is $290 billion and at one point was over a trillion.

In 2012, I could see Miami becoming a global technology city and a leader in innovation. I assembled land in the most strategic areas of the city and teamed with local partners to entitle and we are developing over 10 million square feet of mixed-use properties in Wynwood, Little Haiti’s Magic City Innovation District.

IW: What are your thoughts on investing in cryptocurrencies or NFTs?

RZ: I am not a big crypto investor, but I am a big collector of NFTs. The reason why I’m not a big crypto investor yet is because I’m concerned about regulatory issues that can affect these companies and it is unchartered waters with future headwinds. But I am passionate and very knowledgeable about it, and I am very familiar with Etherium and Bitcoin, and web 3.0 companies and platforms. It will be a huge opportunity that is similar to Microsoft with the Windows platform and Google with their Android system, to really control the desktops and the platforms for other people to build technology. I feel much safer in cloud computing with Amazon and Microsoft, than I do in crypto.

For NFTs, I collect Teamlab out of Tokyo, and Refik Anadole, which I think are the two of the premier NFT artists in the world. I like being involved with some of the most creative minds on the planet and I have a lot of friends that are big art collectors, I collect what I think is the best and I’m constantly searching that out.

IW: Tell us about some of the philanthropic projects you’re involved with.

RZ: Through the Zangrillo Family Foundation, one project we donated $100,000 to went towards building a tech lab in the Church of Notre Dame in Little Haiti. We partnered with Microsoft to enable all the teenagers in Miami regardless of race or religion to have free access to technology, coding and literacy classes, along with mentorship programs outside of the lab. The second project is our Global Empowerment backpacks which includes books that all the successful entrepreneurs have used to build their companies as well as art supplies for those wishing to pursue creative fields and we also have a mentorship program. These kids would not only get the books and knowledge from reading, or art supplies but are also taught about sustainability. They can log on to a mentorship program and connect with entrepreneurs, food experts that also discuss mental health and overall health and wellness.

IW: What do you see as the most interesting sectors to invest in?

RZ: We love real estate in Miami. This is going to continue for the next 10-15 years and will be a core part of our strategy. We also took one of our portfolio companies public, Selina which has 160 hotels in 25 different countries focused on the digital nomad or the remote worker. We see a trend where the new millennials will focus more on experience than they do on materialistic items. They get more pleasure out of going surfing while they’re working remotely than they do out of buying a particular brand of clothes. Our core real estate is in Miami, and we are investing in best of breed technology managers or venture capital firms. We are also building out Dragon.ai, a unique, innovative artificial intelligence company to enhance investor returns, empower our portfolio companies, provide our co-investment partners with valuable insights, and provide strategic advice to our strategic LPs, identify the next Amazon or Apple and we will invest in the growth capital stage or large investments in the public

space.

In real estate we have a half million square foot project on the Miami River, which would be a combination of luxury apartments and office space with dock space and restaurants on the Miami River. I’m also working with Related on a big project in Wynwood, which is almost complete. The Magic City innovation district is zoned for eight 25 story, residential apartment buildings and six 20 story office buildings. It will have an entire 1000-foot promenade with interactive lighting on four and a half acres of public space and over a half a million square feet of retail. So those are my big projects.

IW: Tell us about your art collection, how do you select which artists to collect?

RZ: I really look for things that I like and feel a connection to, and I look at things that would look great in my home. Unlike a lot of art collectors, I don’t do it for the money, I do it for the passion. I don’t buy pieces just to make money, I buy pieces to put my home. I spent three times what somebody normally would on my home and the construction and design, is in fact art itself. Highlighting the walls, the koi ponds or the experience inside the house is a reflection of the individual who owns the house.

IW: Do you have any other alternative investments that you’re passionate about?

RZ: In my innovation category, I like climate and some of the energy technologies such hydrogen power and clean technology. There are also some areas where our mission is to leverage artificial intelligence in our community to evolve humanity and the world. If we don’t save our planet, it’s not going to matter. My girlfriend, Daniela Armijos is from Ecuador. She is very passionate about saving the indigenous people in the Amazon. We traveled to the Amazon to live with the Siekopi tribe. It is important to protect the Amazon, not only because it’s the lungs of the planet, but there are enormous benefits from the plant species that we get out of the Amazon.

One of my real passions is in bioscience and biohacking, such as life extension longevity, achieving the longevity escape velocity, which basically to halt biological aging, and epigenetic reprogramming, which is the reversal of aging, and the ability to go backwards in age. Whether it’s using a NovoThor bed for infrared light, cold plunging, or using a PMF technology, there’s a whole host of things I do to either halt or reverse aging.

I don’t invest in this area currently, but I will back other entrepreneurs or venture capitalists that invest in those areas because I do believe in the economic benefit of extending the productivity of humans.