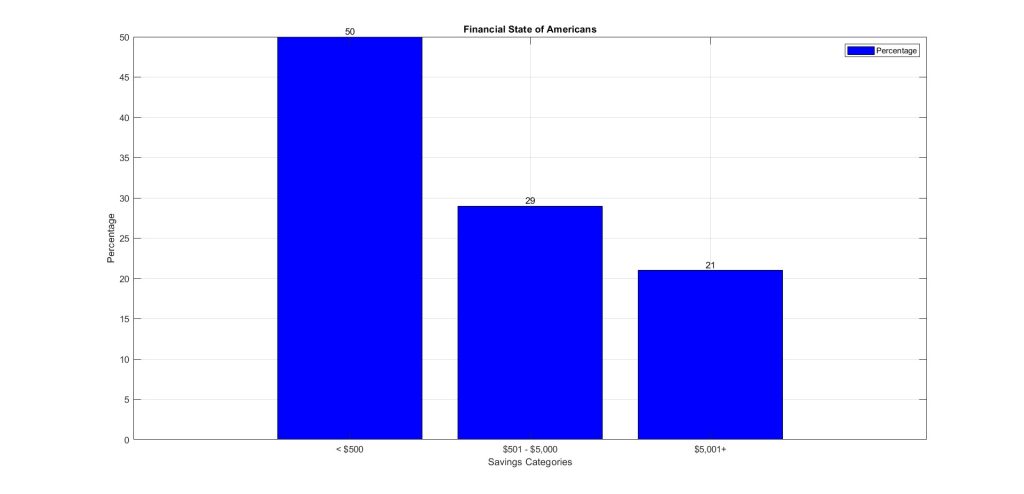

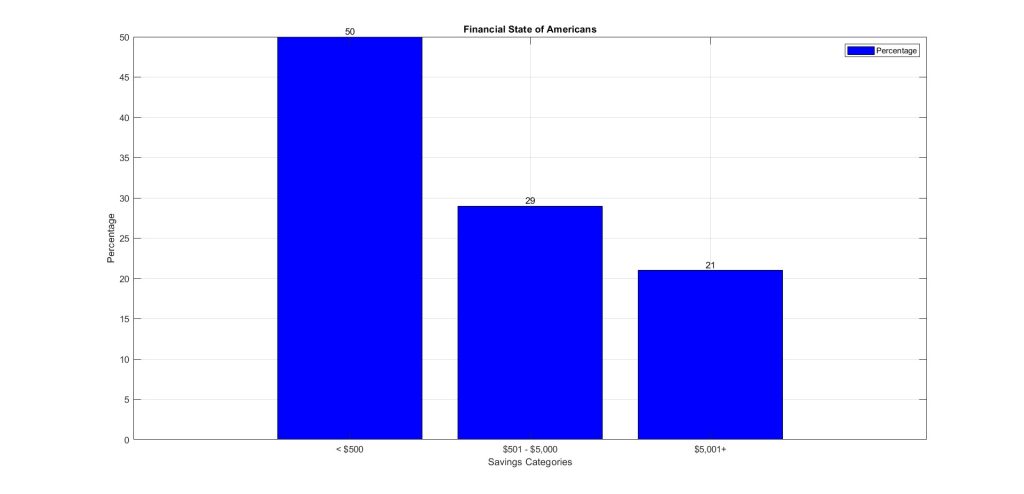

Financial State of Americans: A recent survey conducted by GOBankingRates in November 2023 has shed light on the financial vulnerability of nearly half of Americans, with almost half having $500 or less in their savings accounts. ImpactWealth.Org explores the implications of this startling revelation and emphasizes the critical need for emergency funds in its latest in-depth news report.

The Financial Snapshot:

According to the survey, 29% of respondents fall within the range of $501 to $5,000 in their savings accounts, while the remaining 21% boast savings of $5,001 or more. The situation is not much different when it comes to checking accounts, with 60% reporting balances of $500 or less, leaving them exposed to unexpected expenses. Only a meager 12% have $2,001 or more in their checking accounts.

Living Paycheck to Paycheck:

The findings strongly suggest that a significant portion of Americans are living paycheck to paycheck, highlighting their susceptibility to unforeseen financial challenges. This underscores the importance of establishing an emergency fund, a sentiment echoed by financial experts worldwide.

The Importance of Emergency Funds:

Financial planners universally advocate for the creation of an emergency fund to cushion against unexpected expenses. The inability of many Americans to withstand emergencies costing $500 or more has potentially dire consequences, leading to reliance on high-interest credit cards.

Alex Lozano, a certified financial planner and founder of Lozano Group Wealth Management, emphasizes the financial repercussions, stating that accumulating debt can initiate a cycle of repayment and interest charges that are challenging to escape. Christopher Lazzaro, a chartered financial consultant and founder of Plan For It Financial, adds that an emergency fund is the key to avoiding this debt trap.

Building an Emergency Fund:

Lazzaro suggests aiming for an emergency fund that covers three to six months of expenses, with some individuals needing up to 12 months’ worth of savings. The process begins by allocating a portion of one’s monthly budget to emergency savings contributions. Lozano advises potential investors to prioritize building an emergency fund before making long-term investments, emphasizing that starting small, even with $20 per month, is acceptable.

Stashing Funds in High-Yield Savings Accounts:

Once the emergency fund journey commences, savvy savers are encouraged to consider high-yield savings accounts. These accounts offer annual percentage yields close to 4.5%, a significant increase compared to the average 0.6% for traditional savings accounts, as reported by Bankrate.

Despite the evident benefits, only 9.8% of survey respondents have embraced high-yield savings accounts. Inertia, stemming from loyalty to traditional banking institutions, is identified as a primary reason for this reluctance. However, the potential for higher interest rates makes the switch worthwhile. For instance, a $500 balance in a high-yield account offering 4.5% could yield $22.50 in interest after one year, compared to just $3 with a traditional savings account.

Conclusion:

ImpactWealth.Org urges readers to take these findings seriously, emphasizing the need for financial preparedness in an unpredictable world. The report serves as a wakeup call for Americans to prioritize the establishment of emergency funds and explore high-yield savings accounts, ensuring a more secure financial future. End of Financial State of Americans.