Monzo, the pioneering British digital bank, announced a significant milestone on Tuesday, securing $430 million in a fresh funding round to bolster its reentry into the U.S. market. The funding round was spearheaded by CapitalG, the independent venture arm of tech giant Alphabet, Google’s parent company.

Joining CapitalG in this strategic investment were notable backers including HongShan, the Chinese venture capital firm that recently parted ways with Sequoia Capital, alongside existing investors Tencent and Passion Capital. This substantial infusion of capital marks a pivotal moment for Monzo as it seeks to accelerate its expansion efforts, particularly in the lucrative U.S. market.

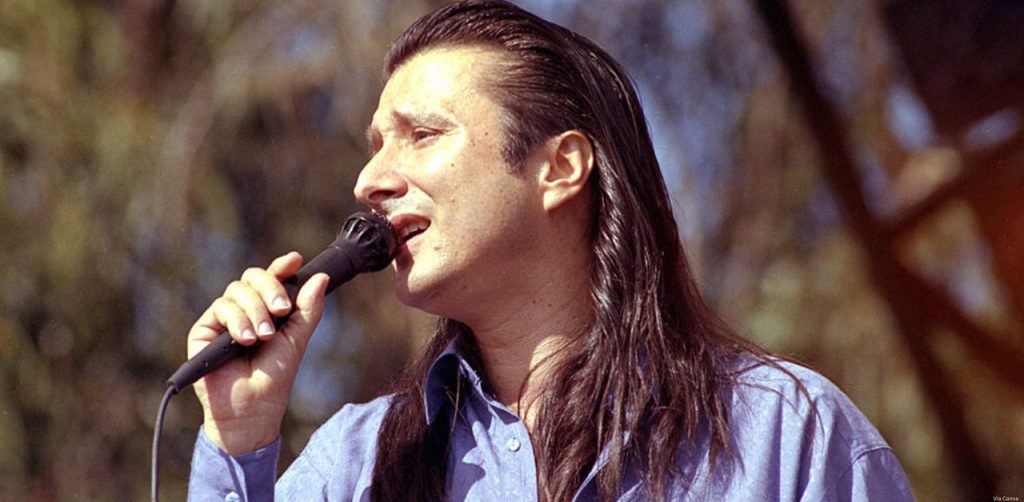

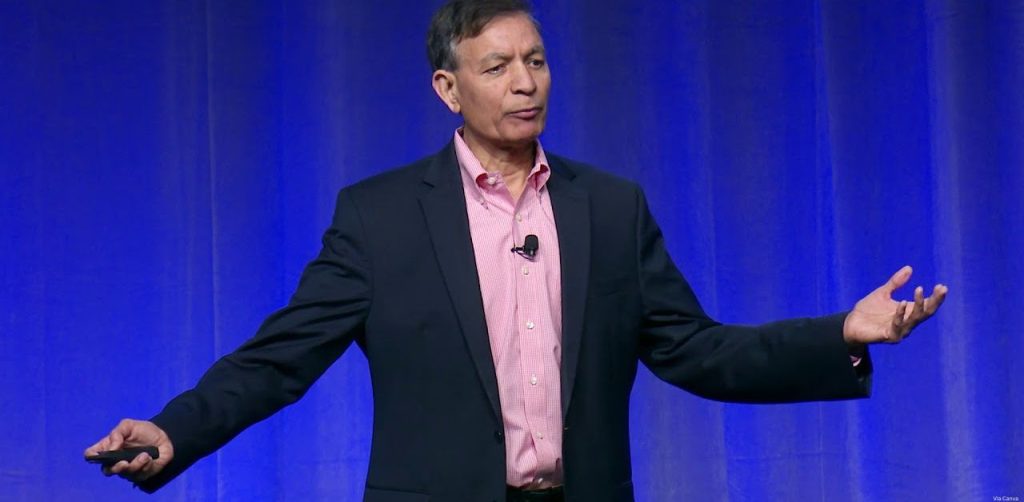

CEO TS Anil expressed optimism about the prospects ahead, stating, “With backing from global investors, we have the rocket fuel to go after our ambitions harder and faster, building Monzo into the one app that sits at the center of our customers’ financial lives.”

Monzo’s resurgence in the U.S. follows setbacks encountered during its initial foray into the American market in 2019. Despite offering a beta product through a partnership with Sutton Bank, Monzo faced regulatory hurdles that led to the abandonment of its pursuit of a full U.S. bank license in 2021. However, with a fresh strategy in place, including the appointment of Conor Walsh as U.S. CEO, a seasoned executive from fintech firm Block’s Cash App division, Monzo is poised for a renewed push into the U.S. market.

The influx of funds coincides with Monzo’s impressive performance in 2023, marked by substantial revenue growth and its entry into investment products. The neobank reported a remarkable 88% increase in revenues, reaching £214.5 million ($272 million), signaling a significant milestone as it achieved profitability in the early months of the year.

Monzo’s commitment to innovation and expansion is further underscored by its introduction of investment pots, enabling customers to diversify their portfolios with offerings managed by BlackRock. With over 9 million retail customers and 400,000 business banking clients in the UK, Monzo continues to solidify its position as a leading app-only bank, poised to seize the immense opportunities presented by the global financial landscape.

As Monzo embarks on its next chapter of growth and expansion, the backing of prominent investors and a strategic focus on product innovation positions the neobank for continued success in revolutionizing the banking experience for millions worldwide. Stay tuned to ImpactWealth.Org for further updates on Monzo’s journey and its impact on the financial industry.

Also read: Britain’s $4.5 Billion Digital Bank Monzo Launches Game-Changing New Investment Feature