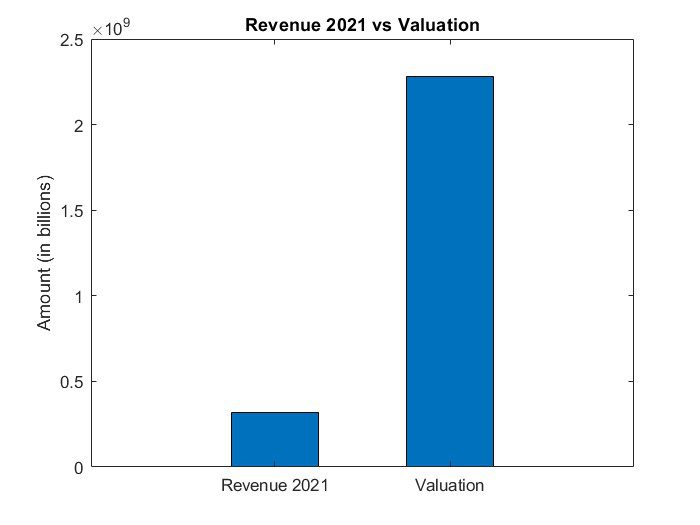

Ibotta, a digital promotions company with significant backing from retail giant Walmart, is set to embark on its initial public offering (IPO), potentially catapulting its valuation to $2.3 billion, more than doubling its worth from a 2019 funding round.

The company, headquartered in Denver, Colorado, filed its intention to go public with the Securities and Exchange Commission on March 22, following the successful IPOs of Astera Labs and Reddit. However, it was only on Monday that Ibotta provided detailed insights into its IPO plans. The amended S-1 filing revealed that Ibotta aims to release over 5.6 million shares priced between $76 and $84, primarily sourced from existing shareholders, with only 2.5 million shares constituting Ibotta’s offering.

This offering represents approximately 21% of all shares, with Ibotta’s outstanding shares totaling 27,221,509. Should the shares be priced at the upper end of the range, Ibotta’s valuation could reach $2.28 billion, potentially generating up to $472.5 million through the IPO.

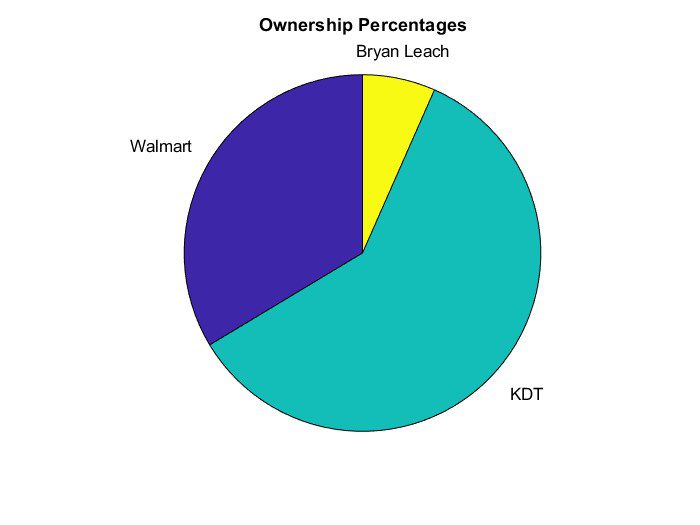

Walmart, holding 2.7 million shares, stands as a major shareholder alongside Koch Disruptive Technologies (KDT), the investment arm of Koch Holdings, with approximately 4.8 million shares. KDT led Ibotta’s series D funding round in 2019, which previously valued the company at around $1 billion.

In terms of control, two of Ibotta’s major venture capital firms, Walmart and Clark Jermoluk Founders Fund, declared they would not be selling any shares, while Koch Industries plans to relinquish just under 5% of its current 20% voting rights. CEO Bryan Leach, retaining almost 70% control, will only sell 531,000 of his 4.26 million shares.

The company, slated to trade on the New York Stock Exchange under the ticker symbol IBTA, achieved profitability in the previous year, recording $320 million in revenue. In a letter accompanying the filing, CEO Bryan Leach reminisced on Ibotta’s humble beginnings, stating it originated “in the windowless basement of an old fire station in downtown Denver.”

“Our capital-light business has enabled rapid growth while enhancing profitability over time and leveraging the benefits of a multi-sided network,” Leach added.

Ibotta’s platform facilitates marketing promotions and rebates for consumer brands, boasting partnerships with over 2,400 brands, including industry titans such as Coca-Cola, Pepsi, Campbell Soup, Kraft Heinz, and General Mills. Notably, the company forged a partnership with Walmart in 2021 to showcase its digital promotions.

Nicholas Smith, an analyst with Renaissance Capital, emphasized Ibotta’s evolution into an enterprise software player, particularly as it powers Walmart’s cash rewards program. “The fact that [Ibotta] has become, with Walmart, more of an enterprise software play…lends more credence to it,” Smith stated in an interview with TechCrunch.

The upcoming IPO signals a significant milestone for Ibotta, underscoring its growth trajectory and market potential as it aims to consolidate its position in the digital promotions landscape.

Wow Similar read: Walmart Expands Media Empire with $2.3 Billion Vizio Acquisition