In the current housing market, securing a mortgage can be challenging due to hefty property prices and stringent lending criteria. If you’re keen to get your foot on the property ladder for the first time or want to secure a larger mortgage for a move, there are many ways to make yourself more appealing to lenders.

Here, we offer some tips to improve your mortgage affordability and get you a step closer to buying your dream home.

- Consider your DTI ratio

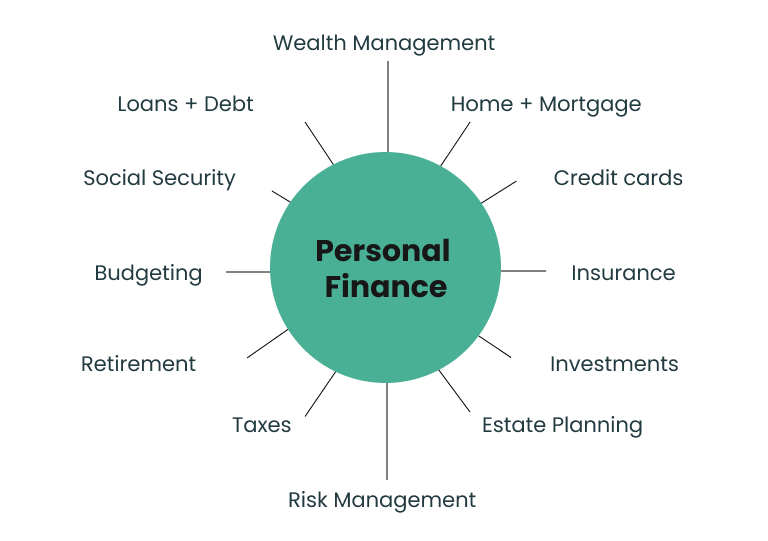

Your Debt-to-Income (DTI) ratio is an important aspect of your finances. It’s essentially the amount of your monthly income that goes towards paying off debt. If it’s low, it can indicate that you have a manageable amount of debt in line with your income, which may make you a more attractive borrower. To improve your DTI ratio, try to lower any existing debts. This can free up disposable income and enhance your affordability profile.

If you need help managing your debts, you could also consider options like debt consolidation. This may be useful if you’re struggling with multiple repayments as it consolidates everything into a single monthly repayment.

- Improve your credit score

A strong credit score demonstrates to lenders that you are a responsible borrower. Your credit report includes details of your credit history, such as credit cards, loans, overdrafts and mortgages.

Experian offers some useful tips on how to improve your credit score. This includes registering on the electoral roll, building up your credit history and keeping your utilisation score as low as possible. Ensure you pay bills on time and make at least the minimum payments on all accounts.

- Consider a longer mortgage term

Opting for a longer mortgage term can reduce your monthly repayments, making it easier to afford a larger loan. However, it’s important to note that while your monthly payments may decrease, the total interest paid over the life of the loan will increase.

Therefore, you should carefully consider your long-term financial plans before choosing a longer mortgage term.

- Close unnecessary accounts

Lenders assess your creditworthiness not only based on your current debts but also on the total amount of credit available to you. Having unused credit cards or large overdraft facilities can be viewed as potential risk factors. To improve your mortgage affordability, consider closing accounts that you no longer use or need.

You could also ask to lower your limits to reduce the overall credit that’s available to you. This might positively impact your score and make you more appealing to lenders.

By focusing on areas like these, you can boost your chances of getting a mortgage that suits your financial situation. Remember to regularly review your circumstances and seek professional advice before making any financial decisions.