In a remarkable twist of fate, shares of Match Group, the parent company of Tinder, experienced a staggering surge of 12% during Tuesday’s morning trading session.

This extraordinary boost can be attributed to reports from The Wall Street Journal, which unveiled Elliott Management’s significant investment – an approximate $1 billion stake – in this renowned online dating company.

After the initial market excitement, the stock stabilized and demonstrated an impressive 6% increase shortly after the opening bell.

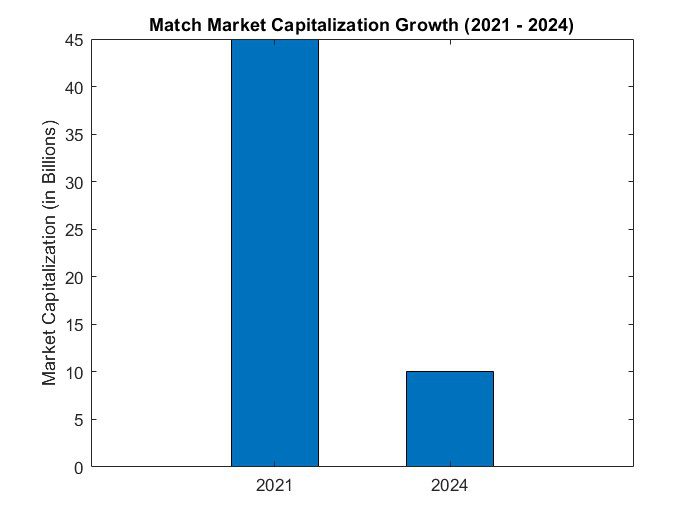

Match, the parent company that oversees Match.com and a range of other well-known online dating platforms, has encountered difficulties in the past few quarters following the initial surge of the pandemic. The market closure on Monday resulted in the company’s valuation at $10 billion, a notable departure from its previously lofty market capitalization of $45 billion in 2021.

Insiders familiar with the situation have disclosed that Elliott plans to establish communication with Match’s management, as reported by The Journal. However, the details of this interaction, such as the potential nomination of directors, have not been made public.

Despite the uncertainties, there are Wall Street analysts who maintain an optimistic outlook on Match. JPMorgan identified the stock as a top pick in December, anticipating a resurgence in Tinder’s double-digit growth, along with other promising indicators.

However, the company experienced a decline in active Tinder users, as reported in the third-quarter earnings of November, and their fourth-quarter revenue projection fell short of expectations.

Match’s boardroom has experienced significant turbulence, witnessing the appointment of seven CEOs since 2012. This surpasses the average CEO tenure of seven years by a wide margin.

Elliott Management has established a reputation for impactful campaigns. In addition to its notable engagements with Salesforce and Pinterest, this investment firm has successfully implemented important changes at Crown Castle, resulting in the replacement of the wireless-infrastructure company’s CEO. Furthermore, Elliott Management has unveiled its intention to secure two board seats at Phillips 66, as previously reported by CNBC.

Jesse Cohn, the brilliant strategist behind Elliott’s recent ventures, has exerted significant influence through serving on the boards of companies such as Citrix, eBay, and Twitter.

At the time of this report, representatives from Match and Elliott Management were not immediately available to provide comments.

Also read: Lego Family Heir Sells $930 Million in Shares, Boosting Siblings’ Stakes