Ever get that feeling you’re being held captive by your professionals? Banking, financial advisors, health, custodians, fiduciaries? We all do, at every level of wealth. Our current ways of doing business practically all require trusting third parties without any way to 100% validate the actions of the partners or principals we are entrusting. In other words, one has to ask for permission for a service rather than having control. The core principle of ‘Blockchain’ is data integrity. Beware as there are a myriad of companies that market software as ‘Blockchain’ without the core attribute of data integrity.

The key question to ask is: “Can someone manipulate the data to backdate or forge information?” If the answer is ‘yes’, the software is a traditional corruptible database masquerading as a ‘Blockchain.’

Blockchain software or more generally ‘public protocols’ are typically accessed with software keys, often referred to as ‘tokens’.

Some public protocols like Bitcoin and Ethereum use an auction style approach. Other public protocols such as Factom or Hercules use a set amount of tokens per service based on the token’s US dollar price.

The reason why blockchain software provides incorruptible data is a result of the data record being distributed and decentralized across many computers referred to as ‘miners’ and ‘nodes’.

The miners are incentivized to continue to protect, record and maintain the information accessed by a public protocol because of the incentive reward received from doing so.

Each miner runs a node to validate the information of the blockchain and non-miners can also maintain a node in some blockchain cases.

Information on a Blockchain is cleared in ‘blocks’ of information over certain time intervals. The interval between blocks of information clearing depends on the Blockchain’s specifications.

The difference between a ‘Blockchain’ and a ‘Blockchain protocol’ is a ‘Blockchain’ both secures and records information itself while a ‘Blockchain protocol’ may secure itself or may rely on another ‘Blockchain’.

The award for the greatest asset appreciation in a 10-year span in recorded history belongs to the Bitcoin Blockchain’s tokens referred to as ‘satoshi’s’.

Since their inception January 3rd, 2009, satoshi’s have appreciated 304,033,233% in US dollar terms.

Each public protocol is effectively a ‘marketplace’ whereby the participants of the marketplace voluntarily decide to participate. All rules of a public protocol ‘marketplace’ are governed by math by machine-driven algorithms.

Today, we understand ‘marketplaces’ to be areas of physical land with forced boundaries known as ‘governments’ which are governed by people with rulebooks as references. All participants are forced into participating in a government marketplace as soon as one physically sets foot into a country.

If a government marketplace participant is caught violating marketplace rules by a human executive, force is exerted as retribution in the form of wealth or personal imprisonment or both.

In a public protocol or ‘voluntary marketplace’, if rules are violated participation is simply voided by the machines without force to the participant.

Over time, the ‘miners’ can adopt versions of a Blockchain public protocol’s ruleset which participants deciding which version of the software to use.

Effectively, Blockchains and public protocols provide a more efficient method of communication both through providing perfectly reconciled accounting as well as eliminating the need for a third party conduit to provide a standard value or ‘money’.

By eliminating the need for a centralized group to define the unit of value in the marketplace by force, public protocol tokens or ‘software keys’ provide for direct payment of services and goods.

Public protocol tokens effectively serve as ‘service keys’ if services are provided in exchange for the token or ‘product keys’ if the token is backed and redeemable for a good such as a gold-backed token.

Each public protocol serves a very specific function powered by computers distributed across the world, known as a ‘world state computer’.

For example, the Bitcoin protocol provides the world’s strongest data security with the Bitcoin network protected by more energy exerted than any other Blockchain public protocol. Sort of like a notary that is impossible to forge and impossible to take down without exerting billions of dollars and growing per day in energy cost.

The Ethereum Blockchain provides the world’s strongest distributed decentralized processor. Sort of like a cloud computer processor impossible to stop without disabling the entire network. The Factom protocol mentioned above provides one of the world’s strongest data layer to aggregate and authenticate information using the Bitcoin Blockchain.

Some public protocols like Bitcoin and Hercules have a definitive number of keys. In Bitcoin’s case, there are 2.1 quadrillion tokens (21,000,000.00000000 exactly, 1 unit of ‘bitcoin’ is actually 100,000,000 Bitcoin software keys or ‘satoshis’). Ethereum public protocol creates a set number of new tokens called ‘ether’ every year.

There are some public protocols that are run strictly with voluntary action without incentive other than the service provided. An example includes the inter planetary file system or ‘IPFS’ the only working data storage public protocol.

The Hercules protocol also mentioned above provides the world’s first and currently only commercial reference protocol by anchoring data into Bitcoin using a layered ‘stack’ of public protocols including Factom, Ethereum and IPFS to minimize overall costs while maximizing speed in a reliable way. Think of Hercules as a distributed decentralized enterprise-level cloud computer with perfect accounting reconciliation and impossible to forge or backdate data with 100% provability.

Blockchains and public protocols can be thought of as bringing the sharing economy to the digital world. Instead of sharing physical resources of vehicles and dwellings like Uber or AirBnB, Blockchains and public protocols enable the sharing of digital resources only possible with the 100% incorruptible security only possible by public protocol software.

The easiest evidence of current data being vulnerable is knowing the largest companies and government institutions in the world have admitted to having their enterprise level database software compromised, whether it be stealing data, changing data or holding data hostage via ransomware.

Through the commercialization of public Blockchain protocols, there is a potential to transform our commercial incentive to a peaceful mutually beneficial way from force and ultimately violence as is best demonstrated by wars. The core reason is the ability of public protocols to keep perfect incorruptible records. Being able to voluntarily track someone’s past actions knowing 100% truthful communication eliminates the current fear everyone currently experiences today of unknowing 100% whether a person is a good or bad actor.

Thus we now have the potential as a species to update our behavior from a deceptive and violent incentive model of commerce, or what is referred to as a ‘prisoner’s dilemma’ game theory, to an honest and peaceful way of voluntary commerce.

The best way to participate? Arguably the best way is to start by doing and buy some tokens to public protocols starting with Bitcoin’s satoshis.

Securing your tokens is crucial. My suggestion is to create a new email address unassociated with any other email or phone number and without any indication of your personal information using a service such as Protonmail. BE SURE TO WRITE THE EMAIL AND PASSWORD ON PHYSICAL PAPER SOMEWHERE SAFE.

Next obtain a free online wallet, also referred to as a ‘hot wallet’. Think of the hot wallet similar to a purse or billfold to keep some but not a large amount of wealth typically accessible from.

I suggest using Edge Wallet both from a security and usability standpoint given enterprise experience with the development teams of the companies I run. AGAIN – BE SURE TO WRITE THE USERNAME AND PASSWORD OF WHICHEVER ‘HOT WALLET(S)’ YOU CHOOSE DOWN.

Next purchase a hardware wallet, also referred to as ‘cold wallet.’ Think of the cold wallet similar to a physical vault where you would keep larger amounts of value in. My favorite brand of hardware ‘cold wallet’ is Ledger for both security and usability with a Ledger Nano S more than sufficient and available for under $100.

The best advice of all I can give for you to become comfortable and over time become an authority? Keep curious and keep doing!

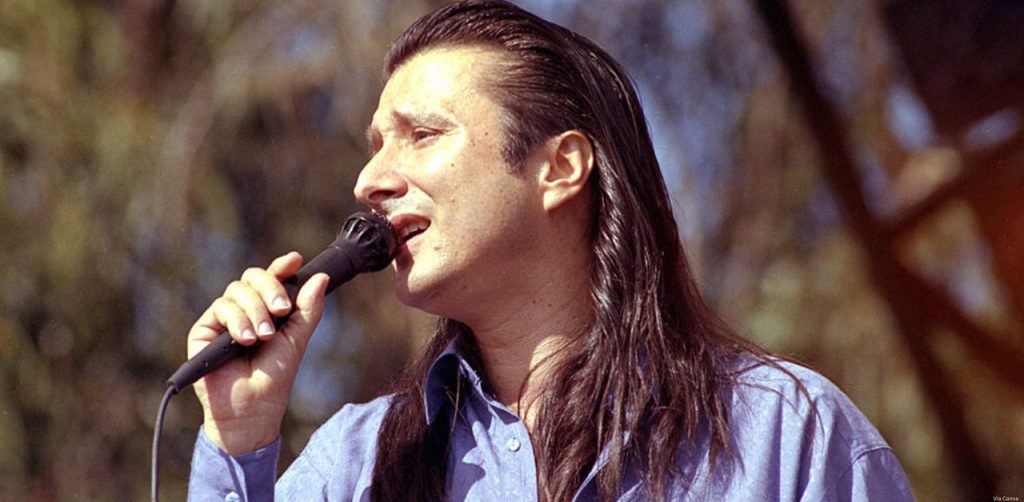

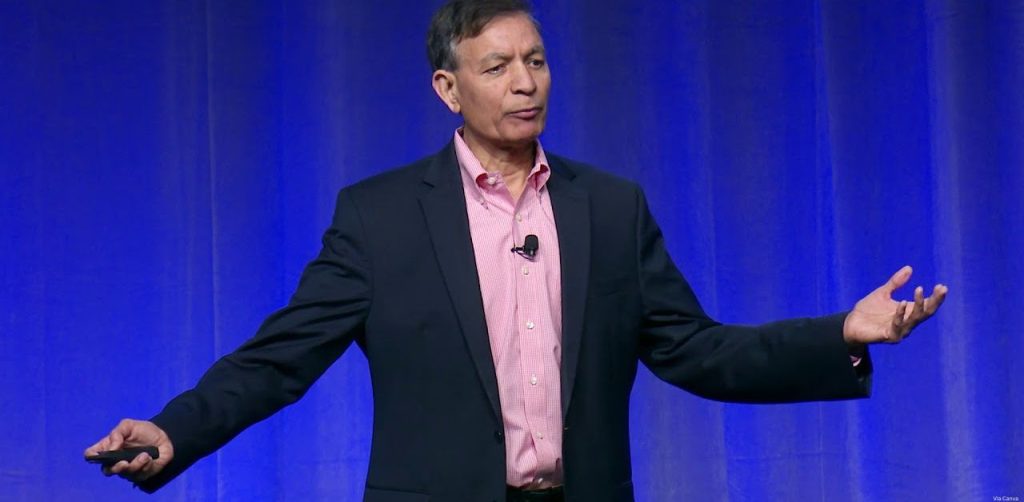

About the Author

Anthem Hayek Blanchard is a 2nd generation family member who is active in running his family office as well as a leader in the cryptocurrency blockchain sector. He is a co-founder of cryptocurrency blockchain company AnthemGold Inc. (AnthemGold.com) and co-founder of precious metals dealer Anthem Vault Inc. (brands: AnthemVault.com, AmagiMetals.com), Mr. Blanchard also serves as both companies’ Chief Executive Officer as well as a member of both Board of Directors.

He was raised by legendary goldbug and precious metals pioneer, James U. Blanchard III, who helped restore Americans’ right to own gold and also founded rare coin and bullion company, Blanchard & Company – once, the world’s largest. As Director of Strategic Development and Marketing with European-based GoldMoney, Anthem helped develop and implement their current business model, overseeing marketing and product development efforts which resulted in an increase of total value held by the company from $1 million in 2002 to $368 million by 2008; today, the company holds over $2 billion in client assets. He also assisted thousands of clients personally over the years, answering their questions regarding buying and selling gold and silver. From 2010-2014 Anthem served as an independent director and member of the audit committee, compensation committee and nominating committee at Pernix Therapeutics Holdings Inc. (ticker symbol: PTX, traded on NASDAQ), a pharmaceutical company based in The Woodlands, Texas.

Anthem holds a Bachelor of Business Administration degree from Goizueta Business School at Emory University, with concentrations in Professional Accounting and Finance.