As the saying goes, time flies when you’re having fun. As we enter the new decade this can be an opportune time for reflection, introspection, and preparation for what lies ahead. While there is nothing mystical about turning the page, sometimes, a major demarcation point marks a time for change in thought and an opportunity to imagine the possibility of unimaginable events that may lie ahead. It may be a good time to question whether or not ideas that have worked in the past, will continue to work going forward. The traditional 60/40 asset allocation model (60% equities, 40% bonds) is precisely the type of issue to question in our view.

The 60/40 model has worked brilliantly for a number of decades. In fact, during the 1Q of 2019, the 60/40 model had its best quarter within the entire decade as both stocks and bonds rallied materially. However, we believe that the laws of gravity dictate that the 40% bond component has severe limitations at this time as a diversifier to an investor’s portfolio. Logic dictates that with major global sovereign debt yields hovering on average around 0%, investors are hampered in utilizing high quality bonds as any true portfolio diversifier as was the original purpose of the 60/40 model. Simply put, when bonds yielded 8% many years ago for example, they represented a tool that could be effectively utilized as a portfolio diversifier, however, at 0%, they cannot. We are not saying anything profound that isn’t readily apparent to all observers. Our experience has been that most investors haven’t found an effective solution given that rising equities have merely been symptomatic of the rise of all boats across the risk spectrum. Many investors have merely buried their heads in the sand because there has been no pain to be had.

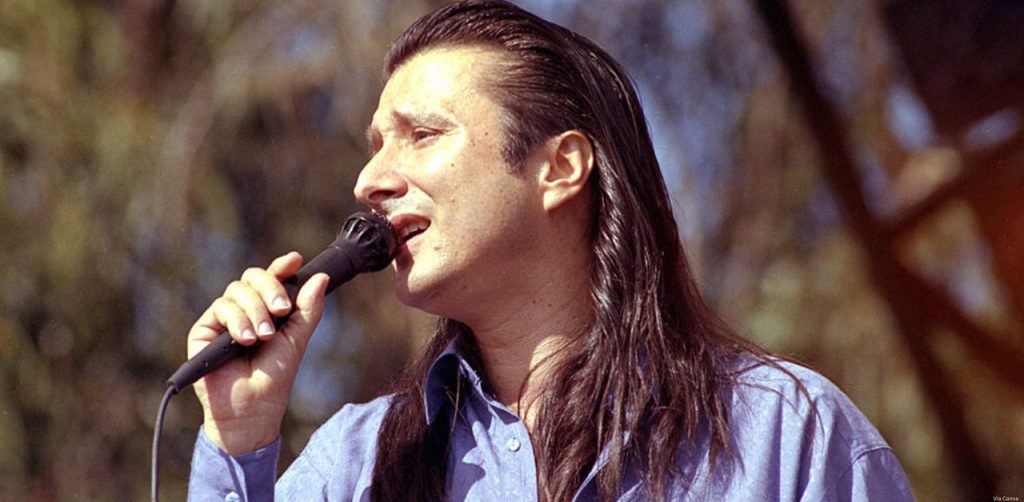

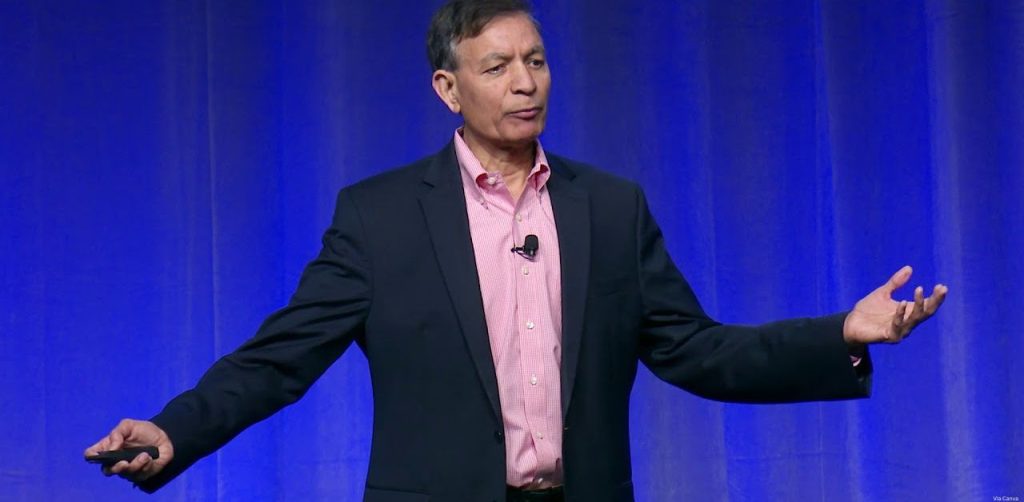

As I enter my 4th decade in the business, I am seasoned enough to recognize that I cannot predict how/when/why the need for balance will arise, rather, I know that it may occur when people least expect it. As we close the decade, we see investors of all stripes taking equity-like risk for bond-like returns in an often misunderstood quest for true portfolio diversification. The true risk of a portfolio is hard to measure unless one acknowledges that simple correlation data is backward looking and that correlation and liquidity on a go-forward basis changes fluidly with the changing market. As such, there is no substitute for qualitative “grey hair” coupled with an independent and open mind as to how to truly manage risk.

I would like to emphasize that while Eagle’s View’s returns have nothing to do with bonds, our Fund may be a fit for those who have an appetite to fill the void in the 40% diversification bucket. Our portfolio of strategies and Managers are designed in the following order of priority: avoid loss of capital during any type of market environment, provide non-correlated returns to equities, bonds, commodities, and other alternative investments, and finally, to produce the highest risk-adjusted returns in the context of our first two mandates. In this quest, we’ve considered both qualitative and quantitative correlation, the possibility for the changing liquidity of markets during times of stress, the risk of crowding associated with certain mainstream securities and strategies when everyone is running for the exit at the same time, and, the need for fluid thinking to address the unknown risks as they arise.