Taiwan Semiconductor Manufacturing Company (TSMC), the world’s largest contract chipmaker, has approved an investment of up to $100 million in Arm, the British semiconductor designer.

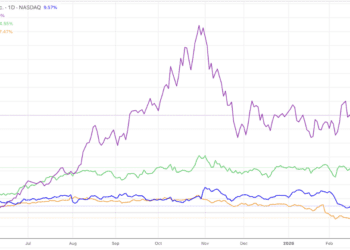

Arm’s initial public offering (IPO) is scheduled to take place this week in the United States, with shares being priced between $47 and $51. This would generate nearly $5 billion in fresh funds for the company and value it at more than $50 billion.

TSMC is one of several technology companies that have expressed interest in investing in Arm’s IPO. Others include Nvidia, Apple, and Qualcomm.

Arm designs the blueprint or chip architecture upon which 99% of the world’s smartphone processors are based. TSMC is the world’s largest and most advanced chipmaker, and it manufactures semiconductors for companies from Apple to Nvidia, many of which are based on Arm architecture.

The investment by TSMC is a vote of confidence in Arm and its future prospects. It also suggests that TSMC sees Arm as a key partner in the development of future chip technologies.

The IPO is expected to be one of the largest in the tech sector this year. It is also seen as a major milestone for Arm, which has been owned by Japanese conglomerate SoftBank since 2016.

The IPO is expected to be heavily oversubscribed, with demand for shares far exceeding the number of shares being offered. This is due to the strong interest in Arm from technology companies and investors alike.

The IPO is also seen as a sign of the growing importance of semiconductors in the global economy. Semiconductors are used in a wide range of devices, from smartphones to cars to medical equipment. The demand for semiconductors is expected to continue to grow in the coming years, making Arm a valuable asset.

The investment by TSMC is a significant development for Arm and its future. It is a sign of the company’s strong potential and the growing importance of semiconductors in the global economy.

Also read: Arm Aims for $52 Billion Valuation in U.S. IPO – What You Need to Know