New research indicates interest in ESG investing Program and Impact funds is holding steady, but it’s paired with hesitation to trust ESG labelling.

In a 2022 Bloomberg article, investor advocacy group As You Sow reported that 60 of 94 ESG funds failed to adhere to ESG investing Program principles. Earlier this year, MSCI planned to downgrade or strip hundreds of ETFs of their ESG ratings.

What’s more, the persistent caution around greenwashing is now joined by another phenomenon – greenhushing – where ESG claims are removed or minimized to avoid the regulatory scrutiny or political backlash those claims can generate.

Regardless of the challenges in validating data, this sector is vibrant, drawing capital and talent from other approaches to wealth creation. UBS reports that family offices allocate more than 20% to ESG investing and project this to hold steady for the next five years. Impact investing is set to grow to 11% allocation.

For funds and companies who have an established ESG strategy, skepticism is welcome. It provides an opportunity for differentiation – but only if a family office is able to consume and track the ESG data now becoming available.

Many reporting sources are becoming standardized and auditable. Carbon accounting is getting smarter, integrating utilities and accounting systems to become more accurate. Further, regulations in Europe and the U.K. are placing standards and establishing consequences for greenwashing.

By collecting and analyzing ESG metrics, family offices can select real greentech and sustainable investing opportunities based on evidence and accountability.

Confronting Unstructured ESG Data

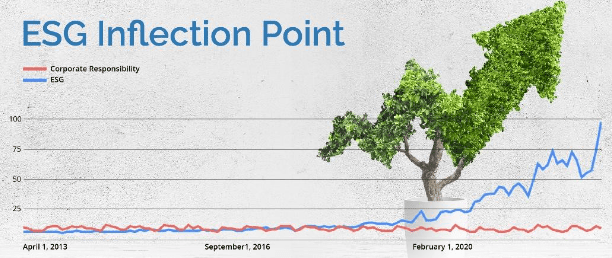

Changes in consumer preferences, new and proposed regulations, greentech innovation, and dramatic headlines all amplify interest in the ESG opportunity. A simple review of popular internet search terms shows an obvious inflection point in public interest over the last few years. See the graph below for case-in-point:

Amid a declining rate of new investments last year, inflows to sustainable funds have been on the rise. McKinsey’s ESG influx research shows them moving from a $5 billion in 2018 to nearly $70 billion in 2021. What’s more, ESG funds gained $87 billion of net new money in the first quarter of 2022.

The interest seems consistent across industries, geographies and company sizes, as organizations allocated more resources toward improving ESG. More than 90 percent of S&P 500 companies now publish ESG reports in some form.

However, in the alternatives space, S&P-style data is less common. Unstructured data is much more prevalent among the greentech startups thriving in the alternatives ecosystem. Naturally, this makes ESG measurement and reporting more challenging for private wealth managers to deliver to their clients.

Still, many appear undeterred by the inadequate reporting, optimistic that as data and standardization improve, the opportunity for impact alpha will follow suit. One hundred percent of private equity investors recently surveyed already incorporate ESG into their investment process. The majority also set ESG targets for their portfolio companies.

GPs, too, recognize that increasing demand for ESG opportunities will be accompanied by a demand for data. In a March 2023 survey of global emerging managers, nearly half (43%) of respondents expected investors to increase their ESG and DEI reporting expectations over the next 12 months.

7 Steps to Establishing a Successful ESG Program

To meet fast-rising impact investing expectations, private wealth management firms would do well to include the implementation of structured ESG programs in their set of strategic priorities.

Regardless of size, there are common features that underpin a solid program. Seven steps to cultivating those features stand out as both prudent and achievable:

- Assign owners. A person, team or collaboration of teams – depending on firm size – should be assigned ownership of ESG data collection. First among this individual’s or team’s responsibilities should be developing a structured means of gathering data within specific time cycles. That’s usually an annual questionnaire.

- Know your obligations. Speak to legal counsel to confirm which regulatory, responsibilities apply to you, and which mandatory disclosures might be available to you based on the sectors and regions you invest in.

- Build a question bank. Jot down a list of questions that captures specific phrasing required and build from there. Once you identify and prioritize your values, a key to transforming those into questions can be as simple as aligning with a common framework like the UN Sustainable Development goals.

- Make it easy. Challenge your teams to make data collection and synthesis as easy as possible for all users. For example, a survey with pre-filled fields beats an open-ended request via email.

- Incentivize. Think about ways to incentivize data reporting from third parties. This may be something as simple as developing and promoting a scoring system that awards points for every completed field in a data-collection survey. Sharing benchmarks that help partners compare their performance against peers can also be a motivator to timely delivery of vital business information.

- Calculate. ESG calculations are often multi-layered. Follow best practices, such as normalizing data at the company level, aggregating at the fund level based on ownership, and converting to different units and currencies.

- Create reporting outputs. Maintain a database of information so you can see gaps in new investment opportunities and compare impact over time. Circulating these regularly as part of quarterly statements strengthens discipline around investment targets and performance expectations and trade-offs.

With ESG opportunities likely to play an increasingly important role in growing family wealth, participation in sustainable funds may very soon become table stakes. Family offices that solidify their strategies for ESG data management and reporting procedures now will be best positioned to prove their success in the future.

Danielle Pepin is the Head of Product for Portfolio Monitoring and Valuation at Dynamo Software, where she oversees Dynamo’s development of user-focused, value-driven portfolio monitoring products for the alternative asset industry. Learn more at dynamosoftware.com.