Investing in the stock market can be daunting, especially when considering blue-chip stocks like Apple Inc. (AAPL). With a history of innovation, robust financial health, and a strong market presence, Apple remains a favorite among investors.

In this comprehensive guide, we’ll explore Apple stock through the lens of FintechZoom, providing insights, analysis, and predictions to help you make informed investment decisions.

Introduction to Apple Inc.

Founded in 1976 by Steve Jobs, Steve Wozniak, and Ronald Wayne, Apple Inc. has transformed from a garage startup to one of the most valuable companies in the world. Known for its innovative products like the iPhone, iPad, Mac, and Apple Watch, Apple has consistently pushed the boundaries of technology and design. The company’s ecosystem, which includes services like Apple Music, iCloud, and the App Store, further strengthens its market position.

Key Financial Metrics

To understand Apple’s stock performance, it’s crucial to look at its key financial metrics:

- Market Capitalization: Apple is one of the first companies to reach a market capitalization of over $2 trillion, highlighting its dominance in the tech industry.

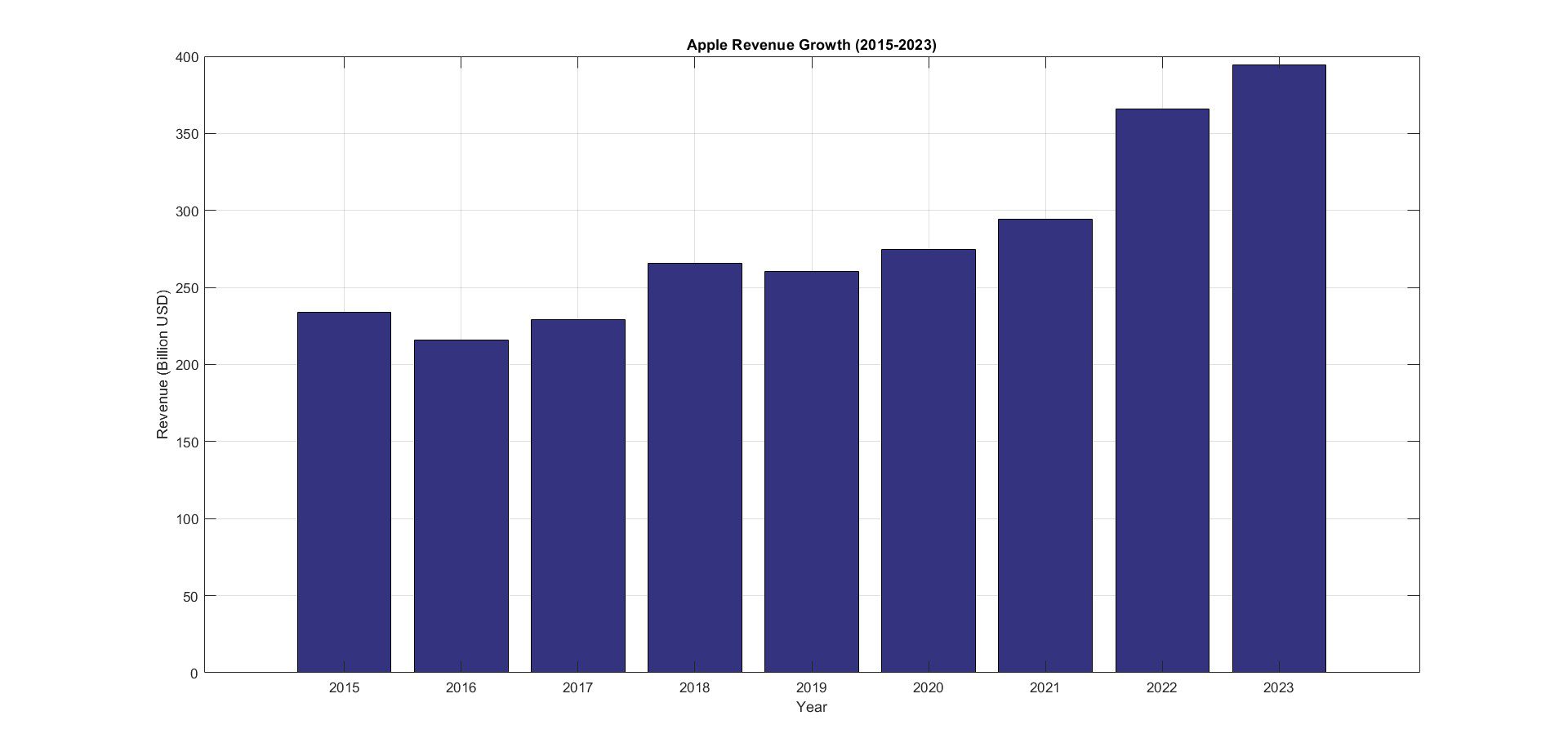

- Revenue: In its fiscal year 2023, Apple reported revenue of $394.3 billion, showcasing its ability to generate significant income consistently.

- Net Income: Apple’s net income for the same period was $94.7 billion, underscoring its profitability.

- Earnings Per Share (EPS): The company’s EPS was $5.61, reflecting strong earnings growth.

Apple’s Business Segments

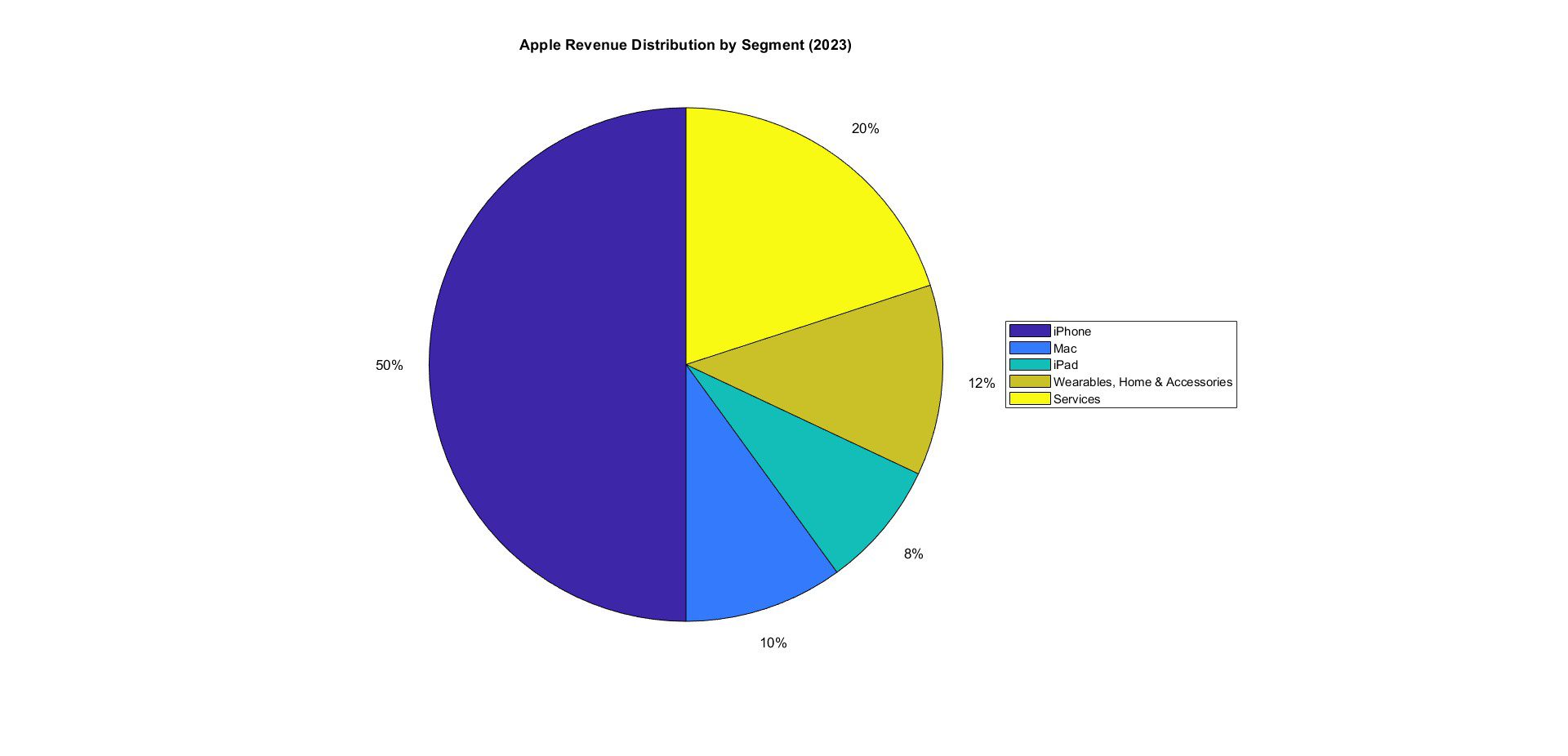

Apple’s business model is diversified across several key segments:

- iPhone: The flagship product accounts for more than half of Apple’s total revenue. The continuous innovation and release of new models drive consistent sales.

- Mac: Apple’s line of personal computers, including the MacBook Air and MacBook Pro, contributes significantly to its revenue.

- iPad: The iPad remains popular in both consumer and education markets.

- Wearables, Home, and Accessories: This segment includes the Apple Watch, AirPods, and HomePod, which have seen substantial growth.

- Services: This fast-growing segment includes the App Store, Apple Music, iCloud, and Apple Pay, contributing to recurring revenue.

FintechZoom: A Vital Resource for Investors

FintechZoom is a financial news and analysis platform that provides real-time data, market insights, and investment tools. For investors interested in Apple stock, FintechZoom offers several valuable resources:

- Real-Time Stock Quotes: FintechZoom provides up-to-the-minute stock quotes for Apple, allowing investors to track price movements and market trends.

- News and Analysis: The platform aggregates news from various sources, providing comprehensive coverage of events that impact Apple’s stock.

- Financial Reports: Investors can access Apple’s quarterly and annual financial reports, offering detailed insights into the company’s performance.

- Technical Analysis Tools: FintechZoom offers tools for technical analysis, helping investors identify patterns and trends in Apple’s stock price.

- Community Insights: FintechZoom’s forums and discussion boards enable investors to share insights and strategies.

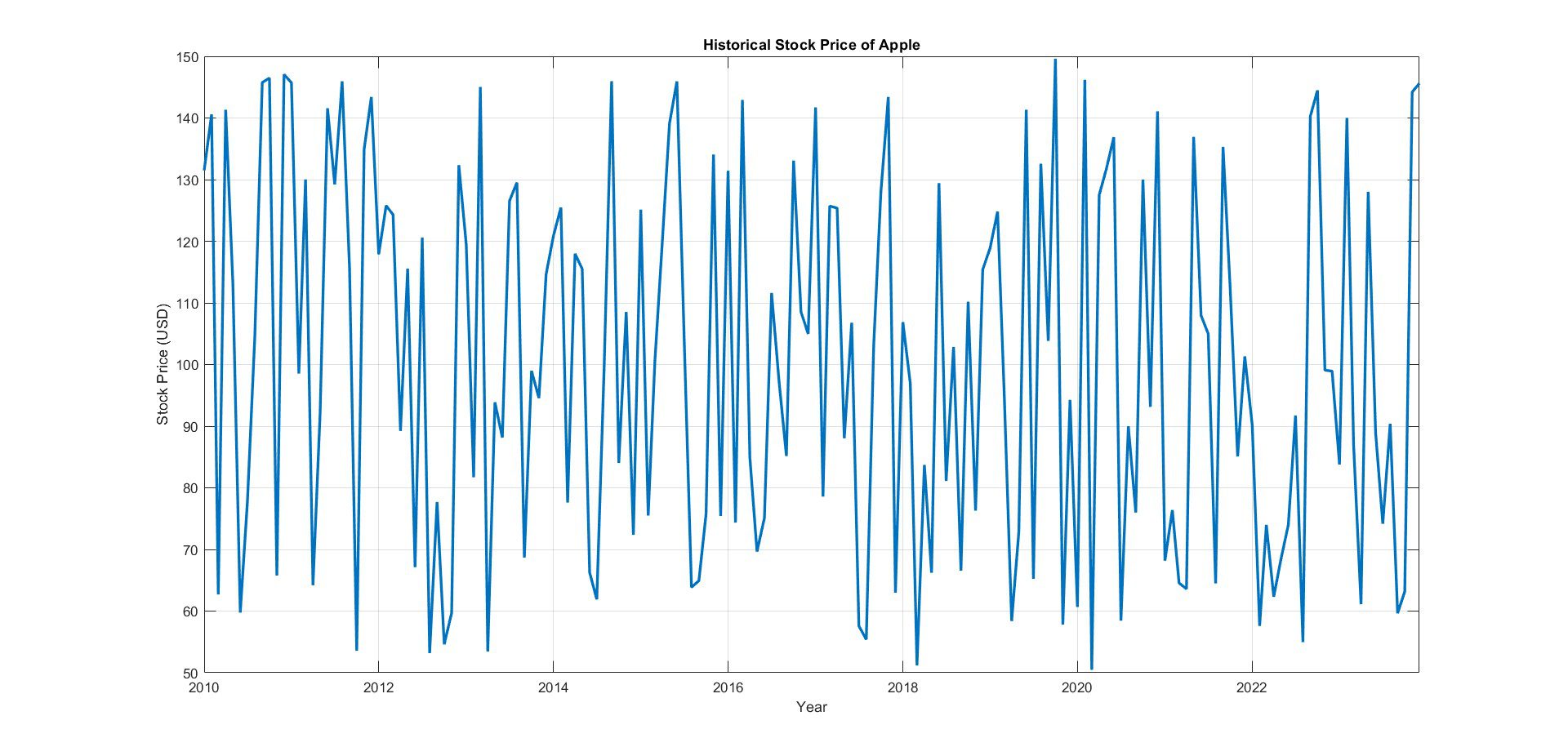

Historical Performance of Apple Stock

Analyzing the historical performance of Apple stock can provide valuable insights into its potential future trajectory.

Early Years and Initial Public Offering (IPO)

Apple went public on December 12, 1980, at $22 per share. The IPO raised $100 million, making it one of the largest public offerings of its time. The stock saw significant growth in the following years, driven by the success of products like the Macintosh.

The Steve Jobs Era

The return of Steve Jobs in 1997 marked a turning point for Apple. Under his leadership, the company introduced groundbreaking products like the iMac, iPod, and iPhone. These innovations revitalized Apple’s brand and drove its stock price to new heights.

Post-Jobs Era and Continued Growth

After Steve Jobs’ death in 2011, Tim Cook took over as CEO. Cook has successfully navigated the company through various challenges, maintaining Apple’s innovative spirit and ensuring steady growth. Under his leadership, Apple introduced new products like the Apple Watch and expanded its services segment.

Recent Performance

In recent years, Apple’s stock has seen impressive gains. The company’s strong financial performance, product innovation, and strategic acquisitions have driven its stock price to record levels. In 2020, Apple became the first U.S. company to reach a market capitalization of $2 trillion, and it continues to grow.

Factors Influencing Apple Stock

Several factors influence Apple’s stock price, including:

- Product Launches: New product releases, such as the latest iPhone or MacBook, often lead to stock price increases due to anticipated sales growth.

- Earnings Reports: Quarterly earnings reports provide insights into Apple’s financial health. Positive results can boost investor confidence, driving the stock price up.

- Market Trends: Broader market trends, including economic conditions and investor sentiment, can impact Apple’s stock price.

- Competition: Apple’s competitive position in the tech industry, including its market share and innovation relative to competitors, affects its stock performance.

- Regulatory Environment: Changes in regulations, particularly those related to technology and international trade, can influence Apple’s stock.

Analysis of Apple Stock on FintechZoom

Technical Analysis

Technical analysis involves studying past market data, primarily price and volume, to forecast future price movements. On FintechZoom, investors can use various tools for technical analysis, including:

- Moving Averages: Simple Moving Average (SMA) and Exponential Moving Average (EMA) help identify trends by smoothing out price data.

- Relative Strength Index (RSI): RSI measures the speed and change of price movements, helping identify overbought or oversold conditions.

- MACD (Moving Average Convergence Divergence): MACD is a trend-following indicator that shows the relationship between two moving averages of a stock’s price.

- Bollinger Bands: These bands use standard deviation to determine the price range of a stock, helping identify volatility and potential buy or sell signals.

Fundamental Analysis

Fundamental analysis involves evaluating a company’s financial statements, management, market position, and growth prospects. Key aspects of Apple’s fundamental analysis on FintechZoom include:

- Revenue and Earnings Growth: Consistent growth in revenue and earnings is a positive indicator of Apple’s financial health.

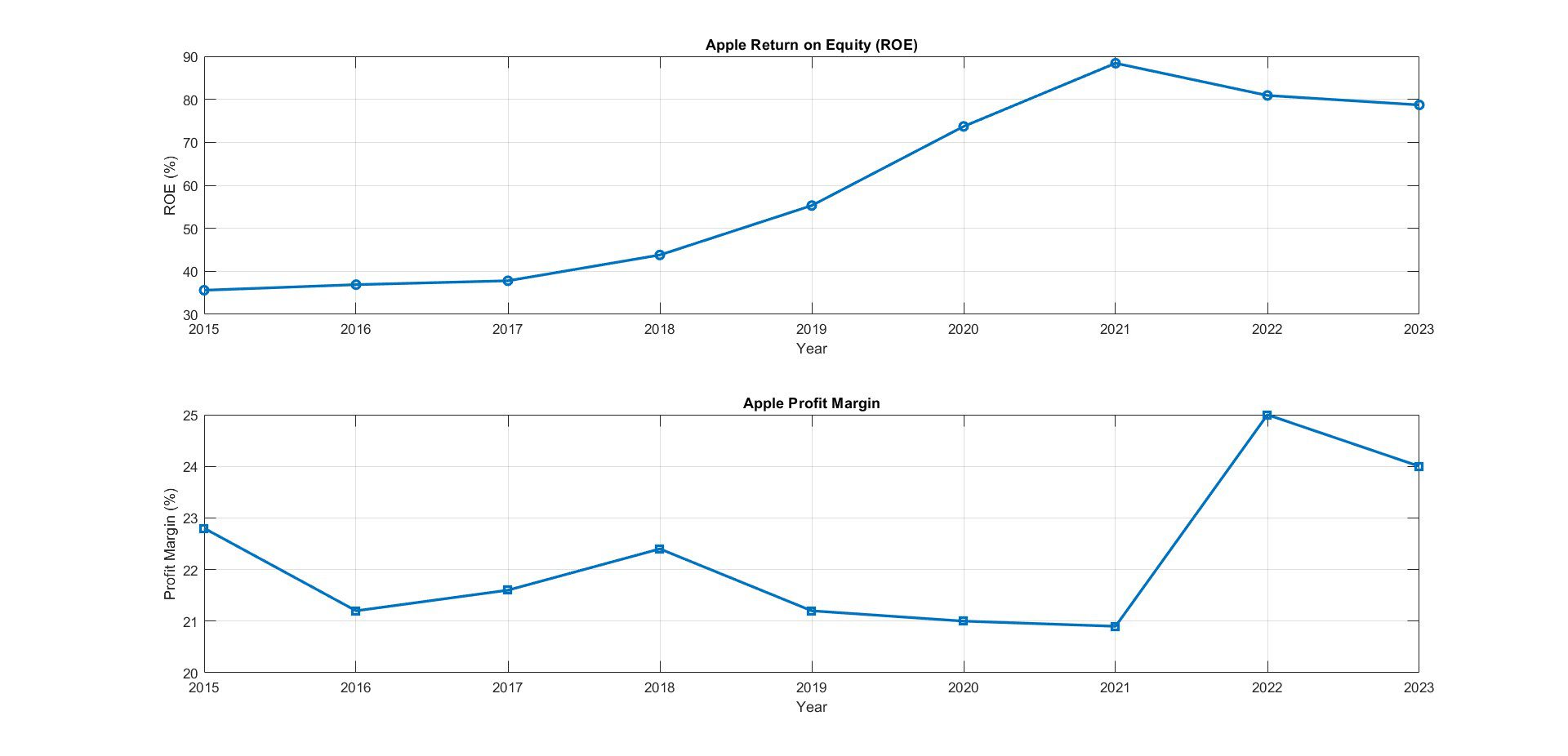

- Profit Margins: Apple’s ability to maintain high profit margins, despite competition and market fluctuations, is a testament to its efficient operations.

- Return on Equity (ROE): A high ROE indicates that Apple effectively uses shareholders’ equity to generate profits.

- Debt Levels: Apple’s debt levels and its ability to service debt are crucial indicators of financial stability.

- Dividend Yield: Apple’s dividend yield and payout ratio provide insights into its commitment to returning value to shareholders.

Market Sentiment

Market sentiment plays a significant role in Apple’s stock performance. FintechZoom tracks investor sentiment through news analysis, social media trends, and discussion forums. Positive sentiment often leads to stock price increases, while negative sentiment can result in declines.

Also read: Understanding the Stock Market FintechZoom: A Comprehensive Guide

Predictions and Future Outlook

Growth Drivers

Several factors are expected to drive Apple’s growth in the coming years:

- 5G Adoption: The widespread adoption of 5G technology is likely to boost iPhone sales, as consumers upgrade to take advantage of faster network speeds.

- Services Expansion: Apple’s services segment, including Apple Music, Apple TV+, and iCloud, continues to grow, providing a steady revenue stream.

- Wearables and Accessories: The growing popularity of Apple Watch and AirPods contributes to Apple’s revenue diversification.

- Emerging Markets: Expanding into emerging markets, particularly in Asia, presents significant growth opportunities for Apple.

- Innovation: Ongoing innovation in products and services ensures Apple remains at the forefront of technology.

Potential Risks

Investors should also consider potential risks:

- Market Saturation: The smartphone market, particularly in developed countries, is approaching saturation, which could limit iPhone sales growth.

- Competition: Intense competition from companies like Samsung, Google, and Huawei poses a threat to Apple’s market share.

- Regulatory Challenges: Increased scrutiny and regulation of tech giants could impact Apple’s operations and profitability.

- Supply Chain Disruptions: Global supply chain issues, such as those caused by the COVID-19 pandemic, can affect production and sales.

Expert Opinions

Financial analysts and experts provide varied predictions for Apple’s stock. Many remain optimistic about its long-term prospects due to its strong financial position and innovation track record. However, some caution that market saturation and regulatory challenges could pose hurdles.

Conclusion

Apple Inc. remains a dominant force in the technology sector, with a strong track record of innovation and financial performance. By leveraging resources like FintechZoom, investors can gain valuable insights into Apple’s stock performance and make informed decisions.

Whether you’re a seasoned investor or new to the market, understanding the key factors influencing Apple’s stock and staying updated with real-time data and analysis is crucial. As always, it’s essential to conduct thorough research and consider your investment goals and risk tolerance before making any investment decisions.

For more detailed analysis and the latest updates on Apple stock, visit FintechZoom and stay informed about the trends shaping the future of one of the world’s most valuable companies.

Also read: Banking with FintechZoom: Revolutionizing Finance Through Technology