Natural gas is one of the world’s most important energy commodities powering our homes, industries, and increasingly playing a vital role in the clean-energy transition. For investors, analysts, and curious consumers alike, understanding natural gas market trends can spell the difference between missed opportunities and informed decisions.

FintechZoom.com shines in this domain, offering real-time data, charts, and expert commentary tailored to the natural gas market. Here’s an in-depth look at everything you need to know about FintechZoom.com natural gas.

What Is FintechZoom.com Natural Gas?

FintechZoom.com is a financial news and data platform covering stocks, cryptocurrencies, fintech, and commodities — including natural gas. Its natural gas section provides:

-

Near real-time price feeds from NYMEX, ICE, Henry Hub, and LNG sources

-

Historical price trends, including seasonality analysis and multiyear cycles

-

Expert commentary on geopolitics, infrastructure, weather, and ESG factors

-

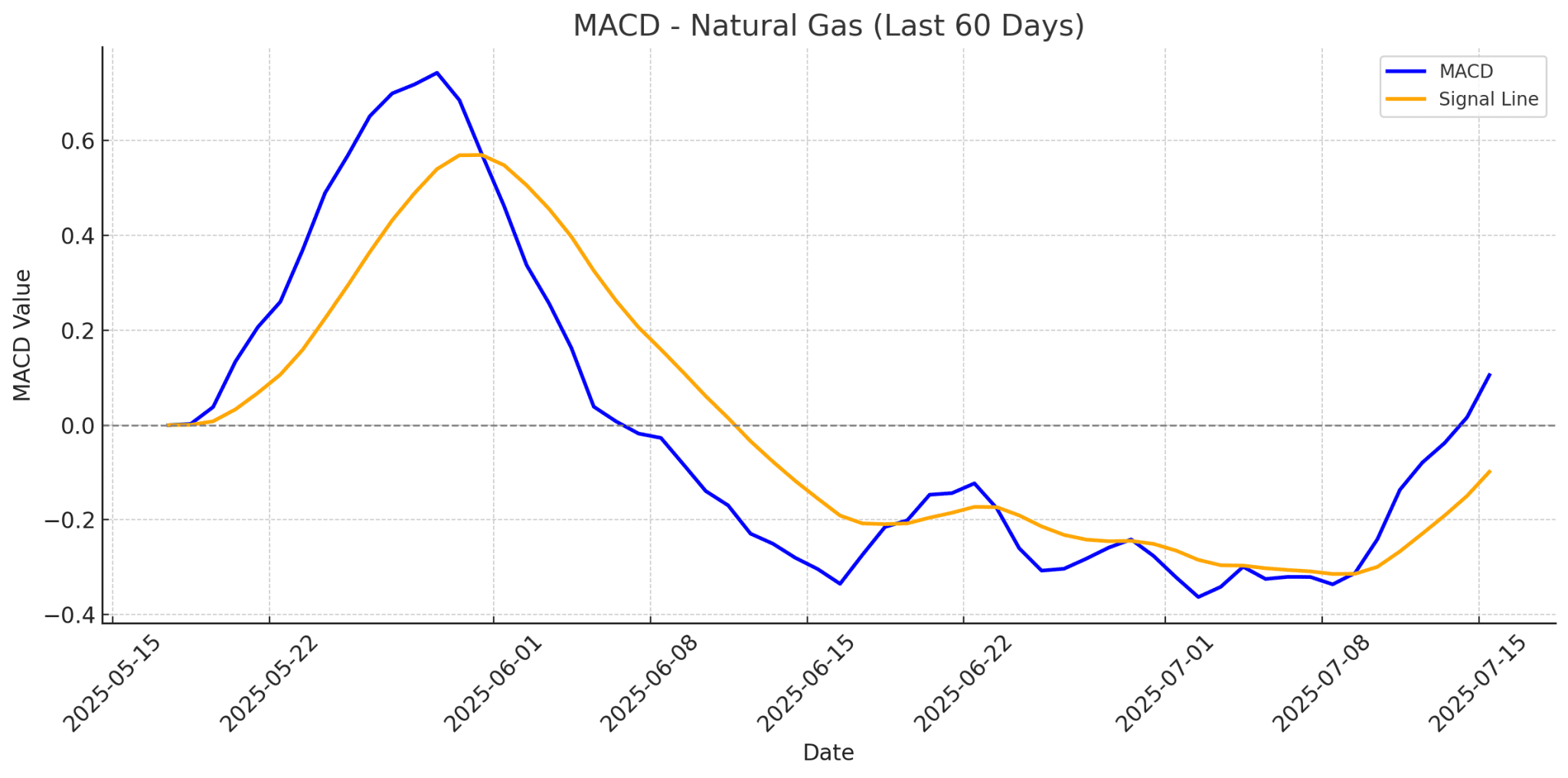

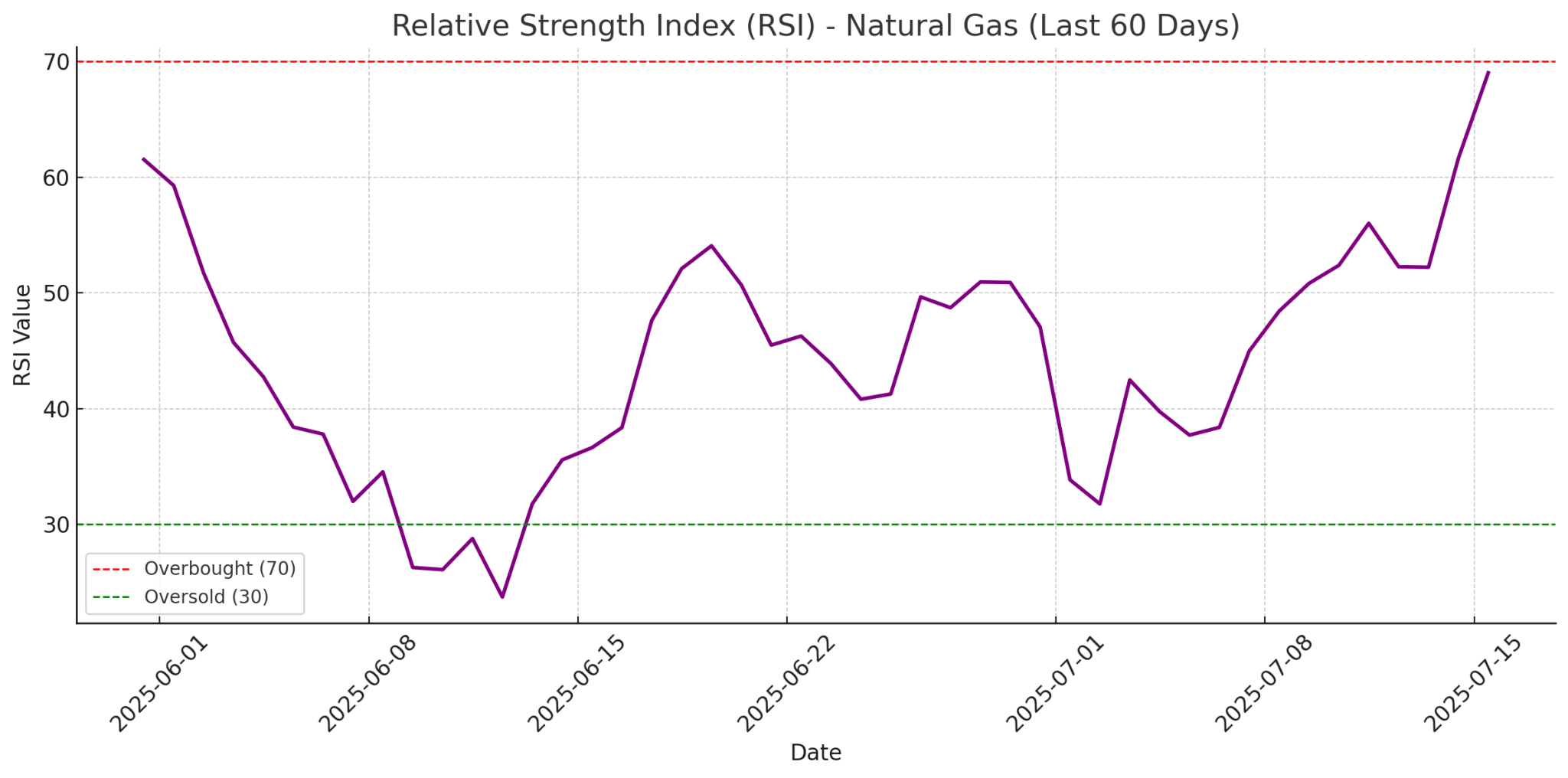

Technical tools like RSI, MACD, candlestick patterns, and proprietary indicators

Whether you’re a seasoned energy trader or a newcomer, this blend of live data, analysis, and alerts offers a one-stop resource for navigating natural gas markets.

Core Features and Tools

FintechZoom.com natural gas stands out with several powerful tools:

-

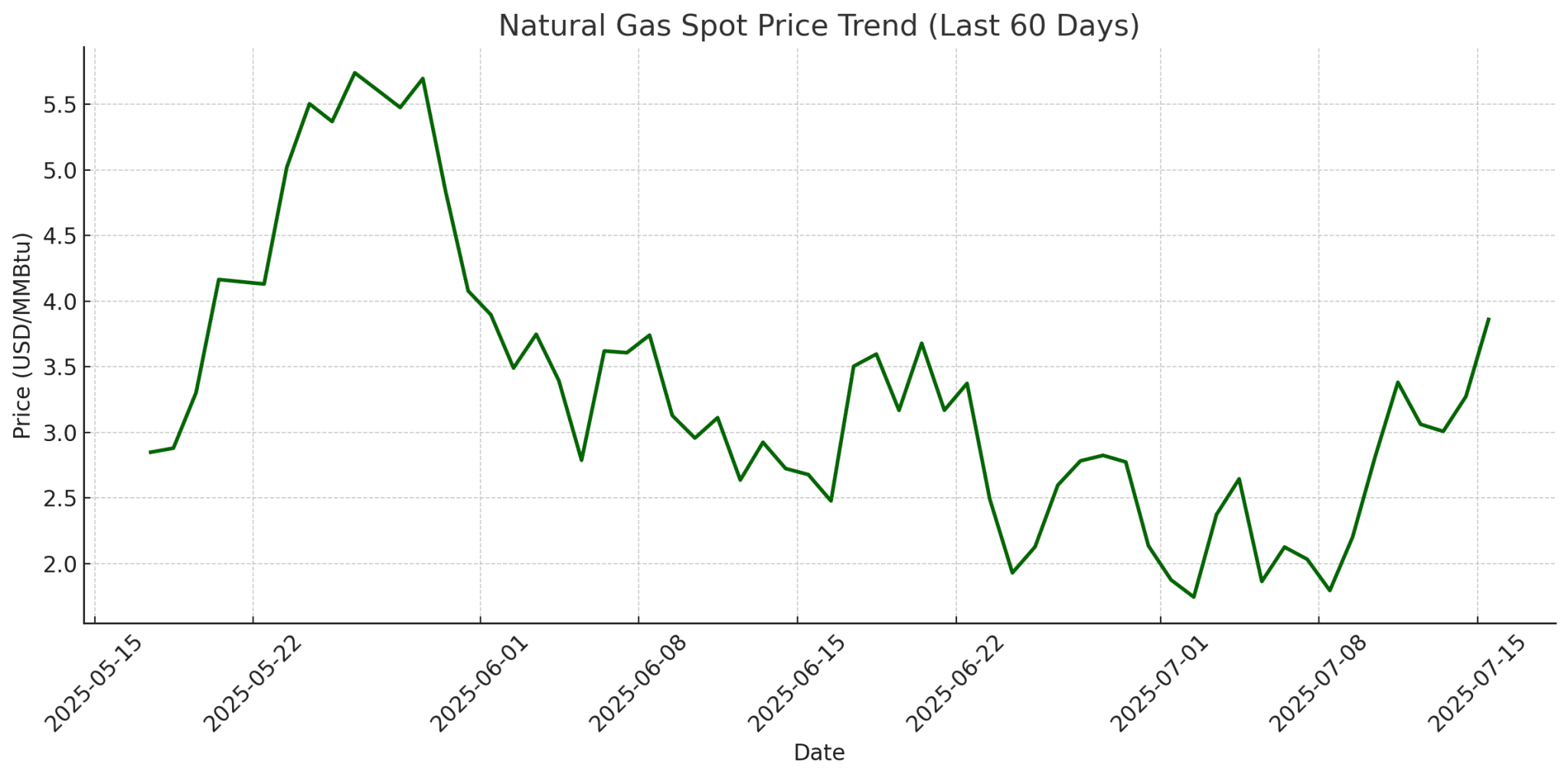

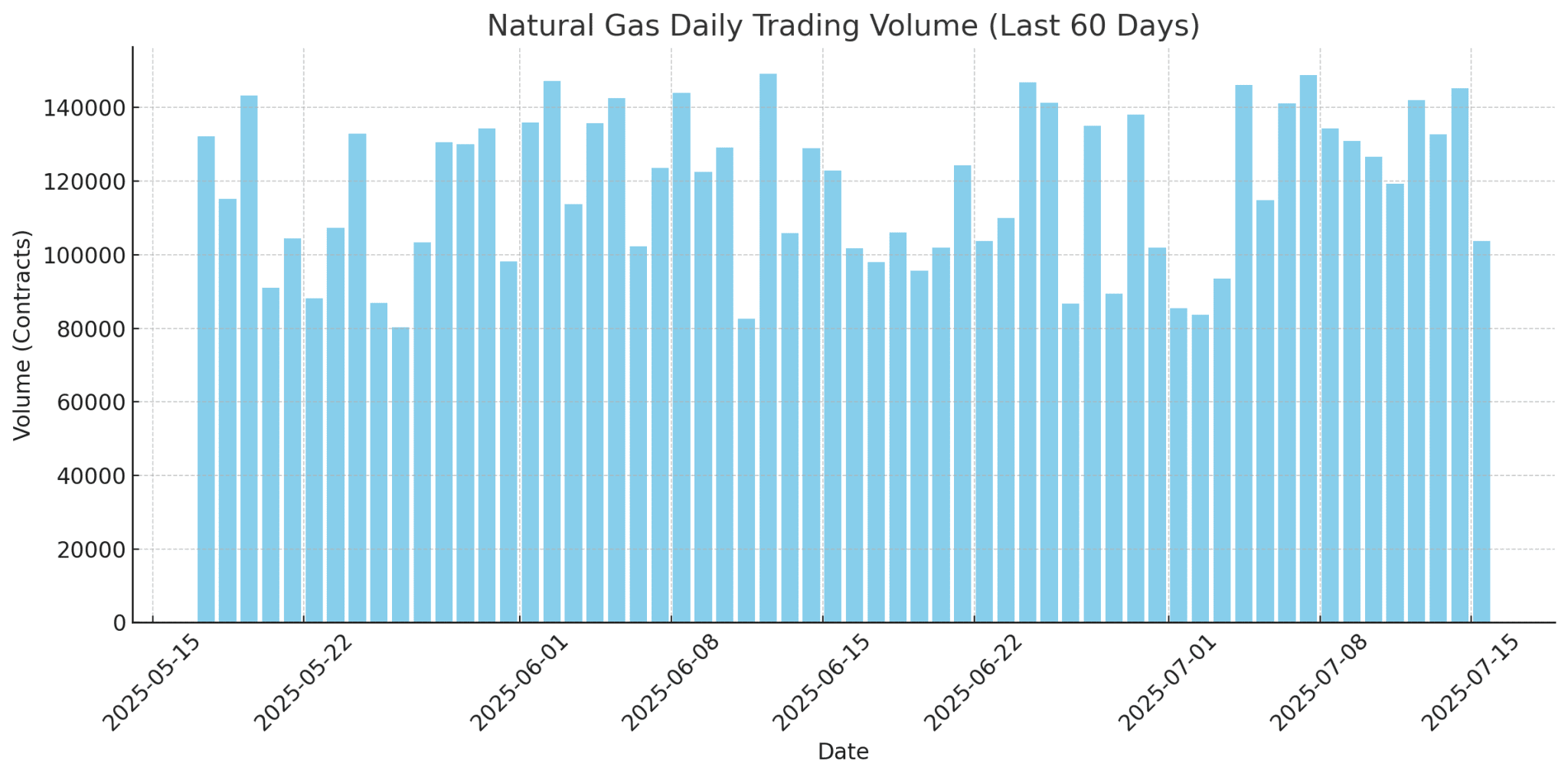

Live Price Feeds: Up-to-date prices from major exchanges like NYMEX and ICE

-

Historical Analysis: Seasonal cycles, trends over years, and supply–demand pattern recognition

-

Expert Insights: Commentary on weather, geopolitics, infrastructure, and ESG

-

Technical Indicators: Includes classic tools (RSI, MACD) and special proprietary chart patterns

-

ESG Overlays: Tracks methane emissions, carbon intensity, and regulatory impacts

-

Alerts & Notifications: Custom price and news alerts to stay ahead

-

Global Coverage: Data and analysis across North America, Europe, and Asia-Pac

This makes FintechZoom.com natural gas a robust yet accessible platform for daily tracking, pattern recognition, and in-depth analysis.

Why Natural Gas Still Matters in 2025

Natural gas remains essential in today’s energy landscape:

-

Cleaner than coal or oil: A “bridge fuel” during the transition to renewables

-

Global demand growth: Driven by industrial use, power generation, and heating

-

LNG and CNG adoption: Boosted by portability and global trade

-

Influenced by weather and geopolitics: Sudden price spikes due to storms or conflicts

-

Vital for clean energy grids: Acts as a backup for intermittent solar and wind

FintechZoom.com tracks these drivers through data and commentary — giving users a front-row seat on market dynamics .

Pros & Cons of Using FintechZoom.com Natural Gas

| Pros | Cons |

|---|---|

| Free & user-friendly | Data may lag direct exchange feeds |

| Real-time prices & alerts | Less institutional-level depth in supply/demand modeling |

| Integrated news & expert insights | Aggregated data may lack full transparency |

| ESG tracking & thematic analysis | Tech tools suitable mainly for retail/intermediate users |

| Global market scope | Not a replacement for paid platforms like Bloomberg, NYMEX |

How to Use It Effectively

-

Start at the Natural Gas Hub: Get live price feeds and monitor daily changes.

-

Examine Historical Trends: Analyze seasonality, storage cycles, and multi-year patterns.

-

Apply Technical Analysis: Use indicators like RSI and MACD in combination with proprietary tools.

-

Enable Alerts: Set notifications for critical price levels or headlines.

-

Study Expert & ESG Commentary: Track how weather or policy shifts affect prices.

-

Cross‑Verify Data: Occasionally compare with TradingView, Investing.com, or direct exchange sources.

-

Integrate into Strategy: Combine technical alerts with fundamental signals (e.g., EIA storage reports).

This strategic use of FintechZoom.com ensures you stay ahead in volatile energy markets — whether you’re a trader, analyst, or informed consumer.

Real‑World Example: 2024 Summer Trade

In mid‑2024, early monsoon rains in Asia boosted LNG demand — while U.S. export bottlenecks tightened global supply. FintechZoom.com’s alert system flagged rising prices, enabling some retail traders to execute a natural gas futures trade yielding +27% in just two months.

It’s this combination of timely signals, fundamentals, and technical clarity that helps market participants gain the edge.

What’s Next for FintechZoom.com Natural Gas?

FintechZoom.com isn’t standing still. Future enhancements include:

-

AI-powered forecasting: Predictive analytics for price and demand trends

-

Blockchain-enabled futures: Tokenized contracts and smart trading APIs

-

Deeper regional insight: Breakdowns by pipeline corridors and export hubs

-

Green-gas data: Carbon intensity metrics across RNG, hydrogen blends

These improvements will push FintechZoom.com from a retail-friendly tool to one with institutional-grade potential.

Also read: FintechZoom .com: What It Is, What It Isn’t, and Where to Find Better Fintech Insights in 2025

Final Verdict

FintechZoom.com natural gas offers a compelling mix of live market data, user-friendly technical tools, expert insights, and ESG themes — all at no cost. While it’s not a Bloomberg or direct exchange feed, it bridges the gap between retail and professional quality.

-

For new investors: It’s a hands-on introduction to natural gas trading

-

For energy analysts: A quick yet resource-rich dashboard for daily monitoring

-

For consumers: A way to understand real-world energy costs and trends

If you’re tracking or investing in natural gas — or even just curious about how energy markets move — FintechZoom.com natural gas is a top-tier starting point.

In Summary:

FintechZoom.com natural gas offers real-time data, robust technical tools, and expert insights — making it an essential asset for anyone interested in energy markets. With innovations ahead, it’s only getting better.

Curious about how to integrate natural gas data into a broader commodities or energy portfolio? I can create tailored content or step-by-step guides next!